Week ended Feb 6, 2026: volatility dominates markets, AI capex concerns resurface

- tim@emorningcoffee.com

- 4 days ago

- 5 min read

Updated: 3 days ago

The A.I. narrative behind the ascension in U.S. tech stocks in 2025 lost further steam this past week, the price of gold stabilised, and cryptocurrencies led by Bitcoin continued to gap lower. Overall, risk sentiment in the market is clearly worsening, although there has been no real sign of panic (aside from the selloff in cryptos). Just when you might have thought things were completely unravelling, the “buy-the-dippers” rocked up on Friday to salvage what would have otherwise been a poor week in U.S. equities.

In this update, I will cover the performance of Mag 7 stocks (again), the U.S. jobs market, European central bank decisions and my own trades in January.

Before diving into this update, hats off to Citadel CEO Ken Griffin for providing very frank comments regarding a variety of topics at a #WSJ conference last Tuesday in Florida. Mr Griffin is a long-standing Republican. I thought his comments were fair, balanced and very much down-the-middle politically. I agree with much of what he had to say, especially regarding the deteriorating fiscal situation of the U.S. Also, unlike many corporate leaders and politicians, he spoke truth in terms of blatant graft in the Trump Administration and the distasteful need for CEOs and others to suck up to this president (and to be fair, to former administrations). You can watch to the full interview (34 minutes) on the WSJ website site here, and on #YouTube here. It is well worth a watch.

S&P 500 earnings – focus on two more Mag 7 companies (part 2)

Both Alphabet (GOOG) and Amazon (AMZN) reported earnings last week. These followed earnings releases from AAPL, MSFT, META and TSLA the week before.

GOOG beat consensus analysts’ expectations for the most recent quarter on the top- and bottom-line, but also increased their expected capex to fund A.I. data centres in 2026 to $175 billion to $185 billion, more than double the spend in 2025. This disclosure put the “ROI on A.I. investment spend” topic back on the table, and coupled with general weakness in tech shares, pushed GOOG lower on the week in spite of strong earnings. The earnings report from GOOG’s website is here.

AMZN reported Thursday after the bell, beating on the top line but falling slightly short on the bottom line. Still, it was a solid quarter for the company, with YoY sales up 14%, and YoY earnings up 4.8%. However, what spooked investors was the revisions for the year to capex spend, mostly related to investment in A.I. data centres. AMZN said it would spend up to $200 billion in capex in 2026, higher than analysts’ consensus expectations of $147 billion (and compared to $131 billion in 2025). The stock got hammered on Friday. The earnings report from AMZN’s website is here.

Tech shares have been under intense pressure now for two weeks running, in spite of what has generally been solid earnings from most of the Mag 7 names. The culprit remains capex associated with A.I. investment specifically, and an overall A.I. bubble more broadly. To give you a sense of the magnitude of investment, the graph below from #Bloomberg captures the trend in capital expenditures from hyperscalers AMZN, GOOG, META and MSFT over the last 10 years.

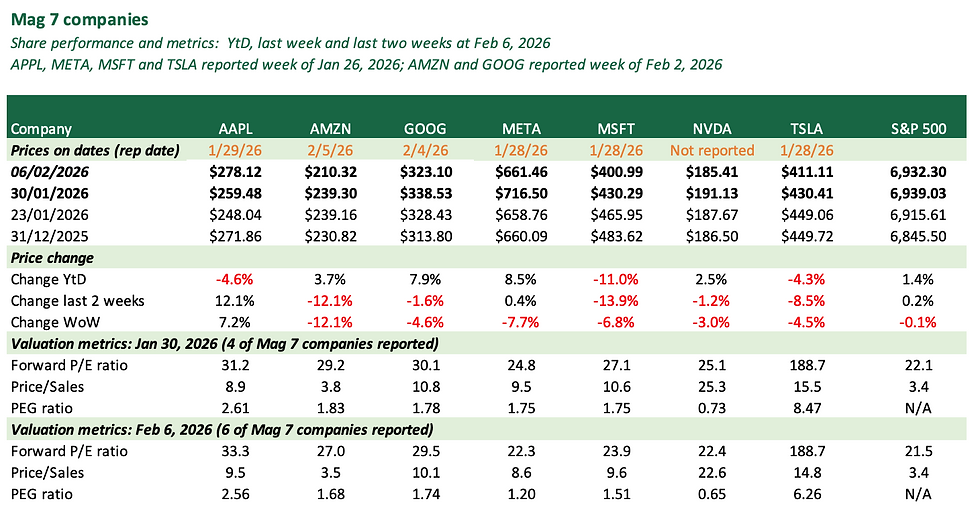

Heady valuations mean that these stocks remain vulnerable in spite of earnings, and the shift in sentiment and ongoing concerns regarding A.I. spend has caused many tech stocks to be re-valued. The table below updates the one I included in last week’s update. It depicts the performance of Mag 7 shares over the last two weeks, along with current valuation metrics.

For a more macro view of S&P 500 earnings this quarter, please see “This Week in Earnings” or “Earnings Insight”.

US jobs market: nuanced but remains solid

US jobs data remains nuanced and mixed, but the jobs market is slowly weakening following several years of robust growth. For some reason, the January jobs report – normally released on the first Friday after the end of the month (which would have been this past Friday) – has been delayed until this coming Wednesday. There is a slew of other relevant jobs data available – some private sector and some government-provided. Focusing just on the figure most watched by ordinary folks, the graph below shows the monthly unemployment rate in the U.S. over the last 78 years:

For reference, the average monthly unemployment rate since 1948 has been 5.7%, and since 2000 has been 5.6%. Since 2000, the lowest monthly employment rate was 3.4% (April 2023), and the highest was 14.8% (April 2020, COVID). The last read of U.S. unemployment rate in December 2025 was 4.4%, a historically low level that demonstrates the size, strength, diversity and resiliency of the U.S. economy including the jobs market.

Central bank decisions: BoE and ECB sit tight

Both the Bank of England and the ECB held rates steady at policy meetings on Thursday. These decisions were largely as expected, although the decision was very close at the BoE (5-4 in favour of holding the policy rate steady vs a 25bps reduction). You can read the policy statements here: BoE here, ECB here (press release).

My trades in January, (re)positioning my portfolio: more defensive

I did a number of trades in January, mostly rebalancing and positioning my portfolio to tilt slightly away from both the tech / AI narrative trade (I have plenty of ongoing exposure there) and consumer discretionary stocks, and slightly more towards defensive sectors like consumer non-cyclicals and healthcare. l lessened my exposure to GOOG, AMZN and AAPL in the first week of the year, and later added to MSFT on weakness following their earnings release. I also added to PG and JNJ post-earnings, both of which had earnings beats but sold off afterwards. On a macro basis, I decreased my exposure to U.S. stocks overall and added to international exposure, specifically to Europe (including UK), Japan and China. Lastly, I added slightly to gold and to corporate credit. All of these cash trades were in modest size, but timing on most looks good in retrospect, at least so far. For protection, I rolled / extended my market puts (hedges) with the latest maturity now out to September 2026. Also, all are now QQQ puts (rather than SPY puts) on the basis that tech shares look the more vulnerable vis-à-vis the market more broadly.

MARKETS LAST WEEK

U.S. stocks were all over the place last week, with the broader tech sector remaining under severe pressure. This includes many of the so-called hyperscalers (as you saw in table above), but the pressure goes much broader and deeper than just the Mag 7. Value stocks have been the principal beneficiaries of the rotation out of tech this year, with the Russell 2000 now up 7.6% YtD. The concentrated large-cap DJIA has also booked solid gains YtD, closing Friday above 50,000 for the first time. Internationally, Japanese stocks were the best performers last week, with stocks in both Europe and Japan outperforming U.S. stocks. UST yields were slightly lower across the curve, as Treasuries racked up modest gains last week. Investment grade bonds were slightly improved, but credit spreads on USD high yield bonds continued to widen. Gold rediscovered its mojo, chalking us nice gains on the week with the haven precious metal now up 13.5% YtD. The worst performer last week was Bitcoin, driven by worsening risk sentiment and (likely) margin unwinds. The benchmark cryptocurrency was down 16.2% last week, and is now down 19.4% YtD.

The tables below have been updated for the end of the week

_________________

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Comments