top of page

Home: Welcome

My view on what's going on in the financial markets and the global economy, and a few other things that might interest me from time to time.

Search

Week ended Jan 2, 2026: welcome to the new year!

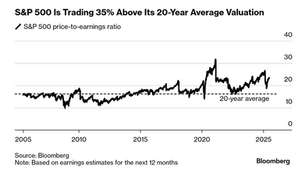

The last two weeks were rather uneventful, so this is a quick summary of price performance in 2025, and a look ahead to 2026. Are we in a bubble and don't know it?

tim@emorningcoffee.com

2 days ago3 min read

Week ended Dec 19th 2025: flawed economic data and central bank decisions

Stocks were mixed last week, with European stocks turning in the best performance of the week, and Japanese stocks the worst. Tech stocks drove the NASDAQ higher, with the DJIA and Russell 2000 losing ground. Treasuries and gold were better bid. The catalysts were US economic data and several important central bank decisions, all of which were as expected. The coming weeks will be holiday-shortened.

tim@emorningcoffee.com

Dec 20, 20254 min read

U.S. Treasury Yields: what's next?

US Treasury yields are stuck, with the 10y UST yielding just north of 4%, What might be coming next? This article presents the factors that will influence the next gap up or down in UST yields.

tim@emorningcoffee.com

Dec 13, 20257 min read

What might A.I. mean for investors?

I am not expert in artificial intelligence, although I do have a basic grasp of its expected benefits balanced by the possible social implications. However, this article focuses on A.I. from an investor's perspective, since the stocks of companies that can attach themselves even loosely to the A.I. narrative have taken off like a rocket.

tim@emorningcoffee.com

Oct 20, 20258 min read

Record high after record high....what to do?

As risk markets surge, especially US stocks (but also corporate bonds), it's hard not to scratch your head and ask how long this can carry on? I have no idea, but I think the end might be near. In the meantime, I stick to my standard investment approach.

tim@emorningcoffee.com

Sep 18, 20256 min read

First half 2025: indices and market update

This article contains tables and commentary regarding the rather volatile but ultimately positive first half of 2025.

tim@emorningcoffee.com

Jul 4, 20256 min read

NATO

NATO was front and centre last week as the annual NATO Summit was held in The Hague on Tuesday and Wednesday, making it an opportune time...

tim@emorningcoffee.com

Jul 2, 20257 min read

"Worst economy ever"? Not even close!

Inspired by Mr Trump's false claims that he inherited the "worst economy ever", this article looks at administrations' economic performance.

tim@emorningcoffee.com

Feb 25, 20256 min read

Cars, tariffs and social security "fraud"

This article summarises two articles and one podcast that are topical,: US/EU automotive tariffs, social security "fraud", and steel tariffs

tim@emorningcoffee.com

Feb 19, 20257 min read

Balance of payments, trade and tariffs

The week started with the Trump Administration announcing tariffs on Mexico, Canada and China, the first two of which were quickly rescinded

tim@emorningcoffee.com

Feb 6, 20259 min read

American Exceptionalism

Better late than never, in that this article is about my views on American exceptionalism, both economically and as far as US stocks.

tim@emorningcoffee.com

Jan 8, 202513 min read

Summary of 2024 in tables

This article contains a summary of full-year 2024 performance of the indices and assets tracked by EMC, plus historical data, too.

tim@emorningcoffee.com

Jan 3, 20251 min read

2024 market and asset performance vs my expectations: how'd I do?

I "guessed" at how markets would perform in 2024 last year at this time. Some I got right, some I got wrong, not different from the pros.

tim@emorningcoffee.com

Dec 31, 20248 min read

A quick look at MicroStrategy (MSTR)

MicroStrategy (MSTR) has had an amazing run since it adopted its Bitcoin accumulation strategy in Aug 2020. Has it run too far too fast?

tim@emorningcoffee.com

Nov 27, 202411 min read

Does the "Trump rally" have legs?

Some stocks that clearly "track" President-elect Trump's varied campaign promises have rallied hard, including TSLA, BTC, COIN and KRE.

tim@emorningcoffee.com

Nov 12, 20245 min read

The US election aftermath: the morning after

This article is short and covers the blowout results and reasons, what Trump 2.0 means for investors, and Mr Trump's promises.

tim@emorningcoffee.com

Nov 7, 20243 min read

The US election: things you should know

Here are a few last-minute thoughts on the US election which will be held on Tuesday, Nov 5. A lot is at stake, but Weds, the world goes on

tim@emorningcoffee.com

Nov 3, 20244 min read

Portfolio update: 3Q2024

This is the update of my personal portfolio for the most recent quarter ended September 30, 2024.

tim@emorningcoffee.com

Oct 9, 20249 min read

Home: Blog2

bottom of page