WEEKLY: Damn glad that's over!

- tim@emorningcoffee.com

- Dec 31, 2022

- 3 min read

Week ended Dec 30, 2022

This is a holiday-abbreviated version of the weekly update, reflecting the time of year (and the fact that I am on holiday although never far from what is going on in the financial markets).

Let me begin by again thanking my followers for sticking with me in 2022. I am especially grateful to the readers of E-MorningCoffee that engage with me from time to time through bilateral emails and occasional “likes” and comments directly on my website. I would like to wish each of you a happy, successful and prosperous 2023. The way I see it, 2023 almost has to be better financially than the “train wreck” that occurred this year, or so I hope.

There was no influential market-shaping news this past week that caught my attention. Many markets were closed one or two days, and even the days that markets were open were rather uneventful. However, in summary it is fair to say that U.S. and European equities felt slightly heavy, somewhat directionless and lacklustre much of the week. You will find a summary of the week further below.

A QUICK (AND DEPRESSING) LOOK BACK AT 2022

I have put together some graphs – certainly not my forte – to summarise returns for the year across various asset classes.

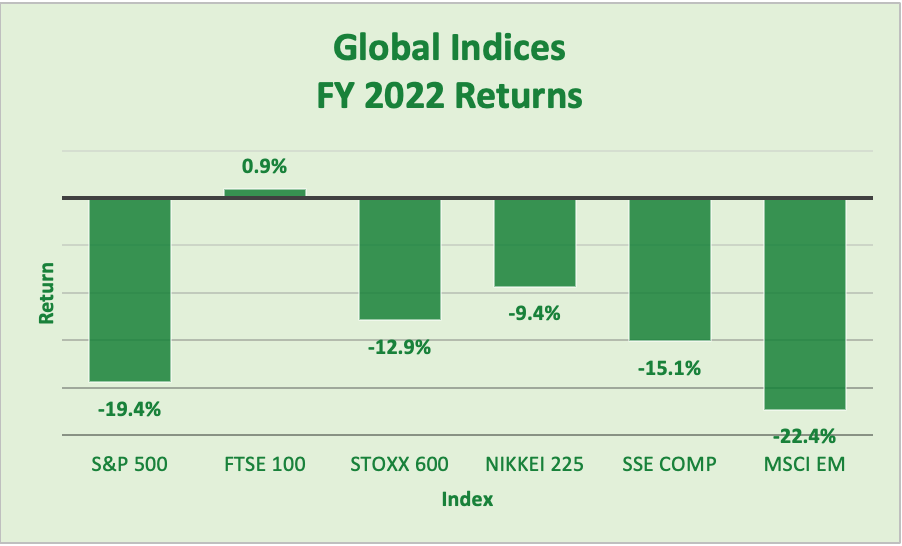

The graph to the right shows 2022 full-year returns for the six global equity indices I track. Only the FTSE 100 was (somehow) positive YoY, reflecting its composition and concentration of commodities and energy companies, sectors that were two of few "right" place to be in 2022. The benchmark US equity index (S&P 500) was nearly the worst performing index of the ones I track, with only emerging markets doing worse.

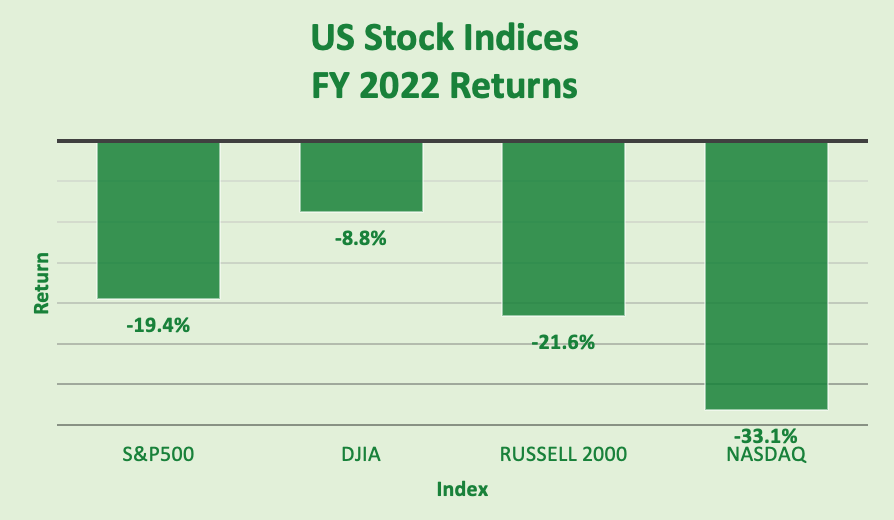

The graph to the left illustrates 2022 full-year returns for the four US equity indices I track. The NASDAQ Composite was by far the worst relative performer YoY, reflecting its composition of more interest-rate sensitive technology companies. The DJIA was the best as investors rotated out of "high flyers" into generally more defensive names.

The graph below compares the three major US equity indices, total returns for US Treasuries in two maturity buckets (7-10 years, and 20+ years), total returns for corporate bonds (investment grade, US$ high yield and € high yield), gold, WTI crude oil and Bitcoin.

As you can see, there weren’t many places to hide this year. And as I wrote earlier this week, predictions for the coming year from the Street, economists and most pundits – including this one – are fairly worthless because they usually turn out to be wrong. But my concerns, at least at the moment, are entered around a slowing economy as central banks tighten policy. For example, I am seeing / hearing about weakness as far as foot traffic in retail, and travel is getting more expensive (and difficult). However, I think we need to get through this holiday period and into January before drawing any conclusions. As I highlighted in an article I wrote recently entitled “Predicting stock prices: 2023”, it is the combination of higher interest rates, slowing earnings growth and consumers blasting through their pandemic savings that gives me a downside bias as far as equities, certainly in the first half of 2023. I do recognise that equities will be in front of general economic trends, and I hope this will enable US stocks to eke out gains for FY2023. Enough guessing…..

MARKETS THIS WEEK

Below is a summary table of markets for this week, and for the full year. Corporate bond spread data is through Dec 29th, 2022. All other levels are as of the close on Dec 30th, 2022. More detail for each of these asset types is below in "The Tables", which have a lot more detail.

WHAT'S COMING IN EARLY 2023 THAT MATTERS

Holidays this week: Monday, Jan 2 (New Year’s observed + other) in the US, UK, Japan and China

Earnings for S&P 500 companies for the most recent quarter will start with the banks in mid-January. JP Morgan, Wells, Citi and Bank of America all report FY earnings on Friday, Jan 13th. Corporates begin slowly reporting earnings the following week.

Upcoming central bank meetings:

Bank of Japan – Jan 17th-18th and Mar 9th-10th

Federal Reserve – Jan 31st/Feb 1st and March 21st-22nd

Bank of England – Feb 2nd and March 23rd

ECB – Feb 2nd and March 23rd

THE TABLES

Global equities

US equities

US Treasuries

Corporate bonds (credit)

Safe haven and other assets

_________________

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Tim thanks for your candid and insightful market analysis and commentary throughout the year. Let's hope for a better year to come. Happy New Year!