Week ended Sept 19, 2025: Fed cuts, stocks like it!

- tim@emorningcoffee.com

- Sep 21, 2025

- 3 min read

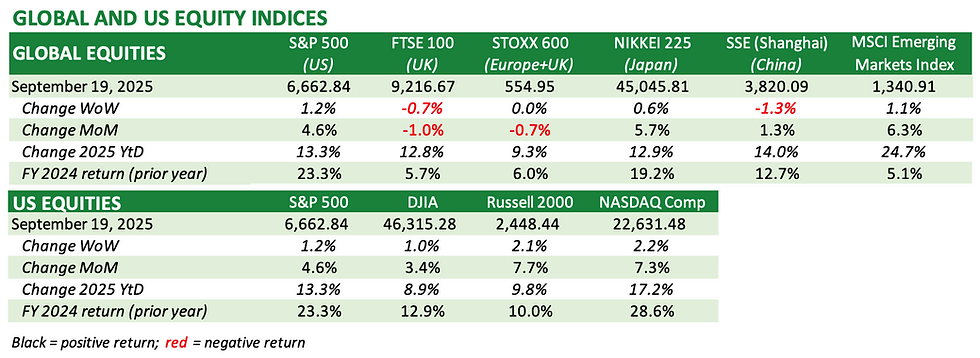

Most global equity markets, led by US stocks, continued to march higher last week. It appears to be getting out of hand. Investors that are long stocks should enjoy it while it lasts. The combination of retail investors experiencing serious levels of FOMO, bolstered by momentum-driven hedge funds hitching on to strong retail-driven inflows into equities, is pushing stock prices higher and higher. The Fed finally cut its policy rate 25bps for the first time this year on Wednesday at its latest FOMC meeting (press release here), and the Revised Economic Projections released concurrently (here) suggest that more cuts are likely ahead. Naturally, this provided further fuel to the fire!

Mr Powell did a good job in his post-FOMC meeting commentary / Q&A (53 mins, video here), with the words and body language well-balanced, as he steered away from presenting a hawkish cut or delving into complicated issues like Fed independence. It’s nice to occasionally have an adult in the room. The FOMC decision was nearly unanimous aside from one governor – Stephen Miran – who just joined the Board of Governors of the Fed and is a Trump nominee. Mr Miran voted for a more dovish 50bps reduction, but he stood alone among voting members of the FOMC in favouring a more aggressive reduction. Once the decision was announced, the short end of the UST curve said “meh”, because you could see the 25bps reduction coming a mile away. However, the intermediate- and long-end of the UST curve remains more challenged and nuanced, with yields actually rising this week in spite of the policy rate reduction, reflecting ongoing concerns about long-term inflation and the deficit-increasing policies of the Trump Administration. In case I haven’t made my point clear: in bonds there is truth.

Of course, as an investor up to his eyeballs in stocks (and a bit of corporate credit on the side, which is at record tight spreads), I welcome the run although I cannot begin to explain the reason that stocks keep going higher and higher given valuations and the economic context. I’m not selling into this because it’s not my style, but I have no qualms about “adjusting around the edges”, reallocating slightly across stocks or broader asset classes based on my views, and trying to protect against a sudden shift in sentiment by employing hedges. I provided a slightly more detailed view of my personal portfolio strategy in an article I wrote a few days ago which you can access on my blog here: “Record high after record high….what to do?”

Away from US markets, Japanese stocks took a hit mid-week on what was perceived by investors as a hawkish monetary shift by the Bank of Japan. The BoJ left the policy rate unchanged (0.5%) although there were two dissenting votes (to increase the policy rate). More troubling to investors in Japanese stocks was the decision by the central bank to sell its riskier ETFs, a form of QT (press release here). Nonetheless, investors in Japanese stocks shook it off as the Nikkei 225 hit a record high on Thursday. In the UK, the effects of questionable growth in the UK (especially retail sales) finally weighed on Sterling in spite of the Bank of England holding firm at its monetary meeting on Thursday (Monetary Policy Summary here). The BoE kept its policy rate intact (4.0%), but eased off its QT slightly. The reality is that inflation remains stuck above target both in the US and the UK, and bond investors are showing just what they think about this in yields.

I will end this diatribe this week by saying long may this one directional way of travel continue ….. although I seriously doubt that it will.

Below are updated tables for the indices and assets tracked by EMC.

_________________

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Comments