Week Ended May 14th: Volatility, Inflation back in Focus

- tim@emorningcoffee.com

- May 15, 2021

- 5 min read

It was clear well before economic data started trickling in this week that inflation was increasing. This of course is by design, an objective of not only the Fed, but of many central banks around the world, so as to reinvigorate economies that have been held back by the pandemic. The challenge for these central banks will be how and when to eventually unwind this unprecedented monetary stimulus, which is increasingly becoming the focus of investors. Some central banks (BoE and ECB) have signalled that tapering is down the road as economies are revived, whilst the Fed has stuck with its mantra that “it is not even thinking about thinking about it” (i.e. reversing its stimulus measures). In some countries, of which the US is by far the leader, fiscal stimulus on top of monetary stimulus is stoking the inflationary fire further. The $4 trillion “ask” of the Biden Administration remains on the table, with the two major parties widely split on the amount that should be spent and the specific programmes (infrastructure, social programmes, etc), as well as how these expenditures should eventually be funded (higher corporate and/or personal taxes). With this context, the higher-than-expected CPI reading for April which was released Wednesday morning (see BLS report here for details) was certain to create more volatility, racheting up inflation expectations and – not surprisingly – leading to knock-on effects into various asset classes along the way.

Although the US is unquestionably the leader as far as unleashing its large arsenal of monetary and fiscal stimulus measures, the effects on economic growth are welcome and positive as the dire effects of the pandemic begin to ever-so-slowly wind down. However, the US is not alone as far as having a brighter outlook. Both the UK and Europe are increasingly raising their output estimates as vaccinations increase and economies creak back open. On Monday, the ECB revised its GDP forecast for 2021 in the Eurozone to 4%, and Bloomberg reported that confidence in the German economy rose to a 21-year high (Bloomberg article here). Not surprisingly, yields on government bonds in both the UK and Eurozone are increasing. Japan is proving to be a different matter altogether, with the Nikkei under intense pressure all week, following the general trend down for similar reasons that have affected global equity markets, and also a uniquely Japanese concern regarding the resurgence in cases of COVID-19. This couldn’t happen at a worse time, as the delayed Summer Olympics are just around the corner. As a result, the Nikkei 2225 was the worst performer last week, and remains the laggard YtD of the indices I track.

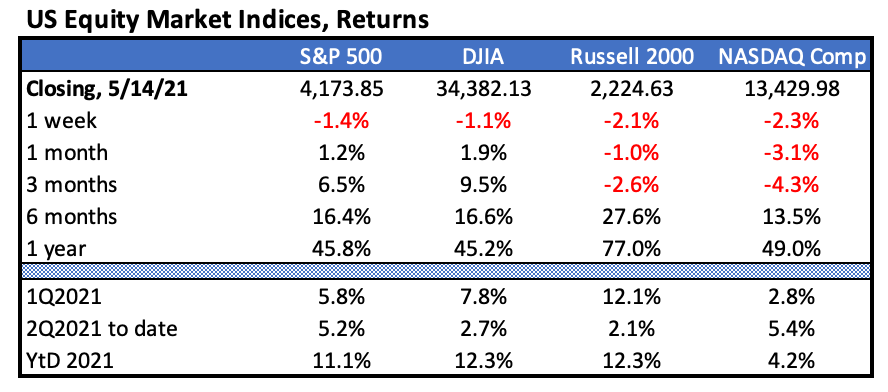

In the US, pressure on equities continued, with selling pressure being broad-based until the CPI figure was released. When higher-than-expected CPI was announced Wednesday morning, the reflation trade re-emerged as tech stocks got hammered and – relatively speaking – cyclical stocks (a la the DJIA) did better. What is increasingly being left behind now, along with the NASDAQ, is the value trade as expressed by the Russell 2000, as you can see in the table below. Friday brought some relief with a rally across the board, as the S&P 500 (as a proxy) was up 1.49% on the day, whilst the NASDAQ composite – the laggard most of the week – was up 2.32%.

Within the tech sector, I would be remiss not to mention that the pain continues to be more broadly felt in the so-called “high flyers”. If you consider ARKK a proxy, the graph below shows the nasty journey of this actively-managed tech-focused ETF since February, when the wheels began to fall off of the high flyers. ARKK’s largest holdings are TSLA, TDOC, ROKU, SQ and ZM (collectively, 30% or so) – here is the entire list of holdings of ARKK straight from the Ark website.

The VIX, or the “fear index” as it often called, had been in the 17-18 context since mid-March, and closed last Friday (May 7th) at 16.69. This week brought volatility back into the market that we haven’t seen in several months, with the VIX increasing to 26.6 (close) on Wednesday. Following two days of relative stability, with especially nice one-way gains on Friday, the VIX closed the week at 18.81. Nonetheless, this week showed a notable increase in risk in the market, worth keeping an eye on going forward.

In corporate credit, both yields and spreads are marginally wider / higher this week (through Thursday's close). The table below show the change in yields in BBB and non-investment grade (high yield) credit, and in USD HY and EUR HY (red showing increasing yields).

In spite of the modest widening, corporate new issuance remains robust across the credit spectrum, illustrating that companies are gorging on debt at these yields. Although below the record new issuance (primary) of 2020, 2021 new issuance levels ($960 bln YtD) in USD is well ahead of 2018 and 2019, as you can see in the graph below from Moody’s.

For comparison, EUR-denominated debt issuance is €360 billion YtD, about one-half the level of new issuance in USD. There can be no better indication of the appetite to issue (and investor appetite) to buy corporate debt than to look at the issue that Amazon (A1/AA-/A+, M/SP/F) did this week. The company raised $18.5 billion of bonds across eight tranches with maturities ranging from two to 40 years. The cost of the debt was very close to what the US government currently pays according to the #FT (see here for FT subscribers), the tightest spread to US Treasury yields ever. For example, the two-year tranche on Amazon bonds had a coupon that was only 0.10% over the yield on the 2-year UST.

In the US Treasury market, government bonds sold off sharply following the release of CPI on Wednesday, but then settled and clawed back some of the losses on Thursday and Friday as things settled down. The yield on the 10-year US Treasury ended the week at 1.63%, 3bps wider on the week. In spite of a lot of turbulence caused by inflationary expectations, the yield curve has not materially changed in the last few weeks as the 2-10 year spread remains in the 1.45%-1.50% range. Bond yields in the UK and Eurozone have also increased materially, reflecting the revisions upwards in growth. It will be an interesting day when the yield on the 10-year Bund reaches 0%!

The US Dollar was marginally better on the week. Gold, having defended a new level in the $1,825/ounce context for several days, moved down rather significantly on Friday as a risk-on attitude gripped the market and investors sold the ultimate safe haven asset, driving it back down below $1,800/ounce (close at $1,793.48/oz). WTI crude also had a wild ride, attributable partially at least to the Colonial Pipeline cyberattack that affected the flow of gasoline in the southeastern US for much of the week. After a lot of ups and downs all week, WTI crude closed the week at $65.31/barrel, +1% W-o-W.

Bitcoin, meme-currency Dogecoin and other cryptocurrencies (except for Ethereum) also were under pressure much of the week, following Elon Musk’s comments, first on #SNL regarding Dogecoin (watch here, “yeah, its [Dogecoin] a hustle”), and then when he commented mid-week that Tesla would abandon accepting Bitcoin because mining the currency uses excessive amounts of energy, much of which comes from fossil fuels. If you have time, you can also find Elon Musk’s entertaining opening monologue from SNL here.

**** Follow emorningcoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Comments