Week ended August 8, 2025: more record highs

- tim@emorningcoffee.com

- Aug 9, 2025

- 5 min read

Quick links:

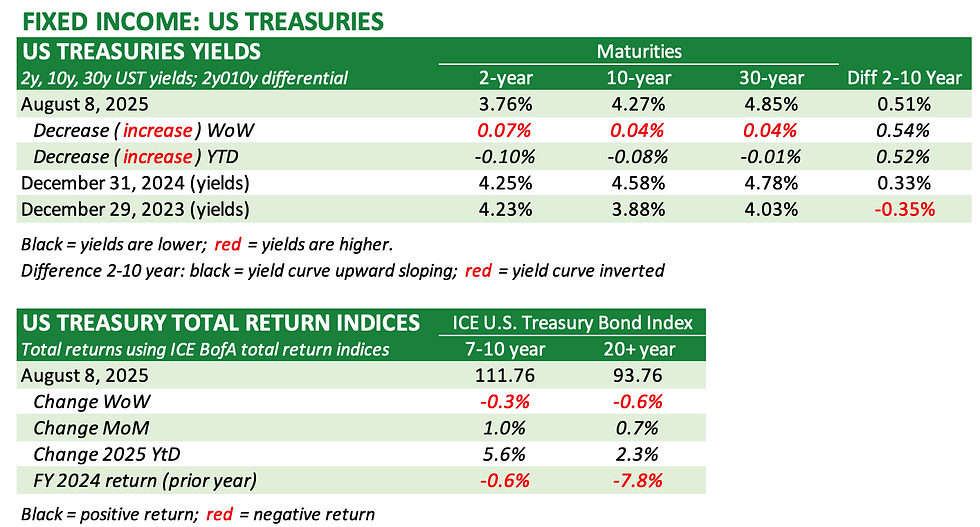

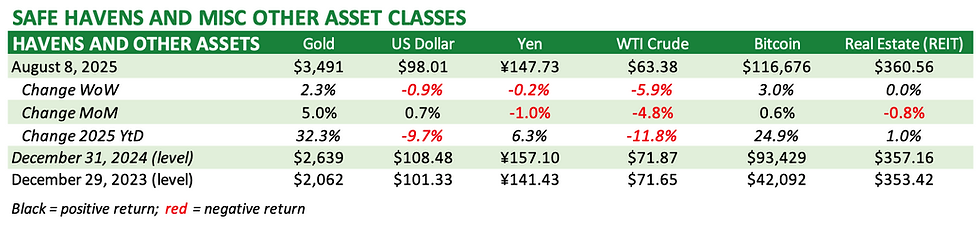

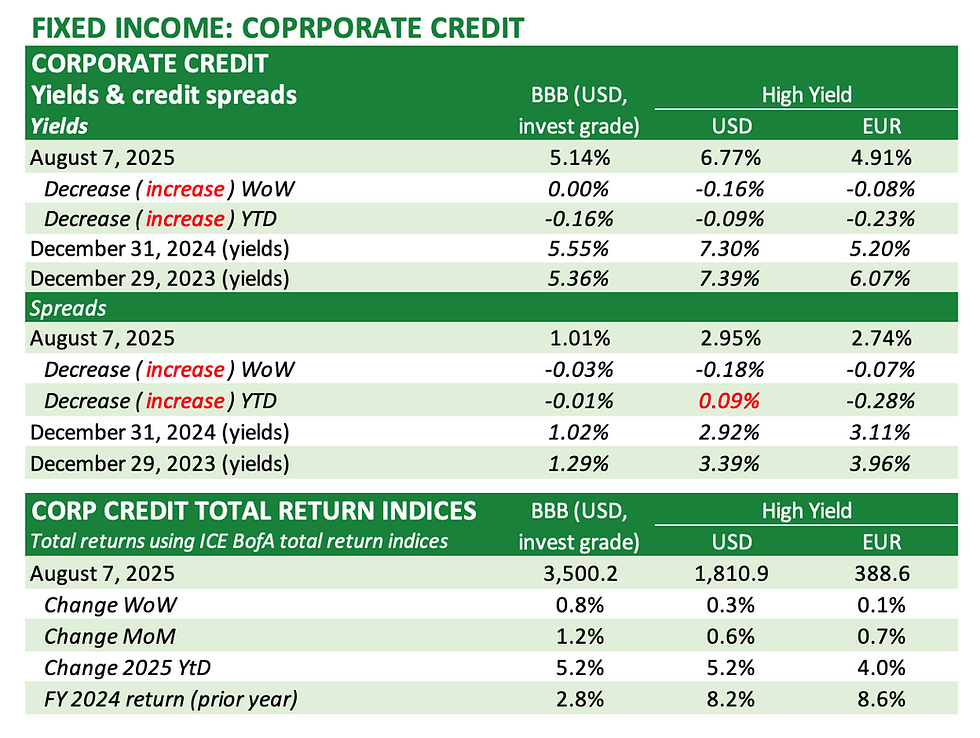

Markets in summary

Markets recovered from last week’s downdraft, with stocks powering ahead around the world. The NASDAQ Composite closed the week at a record high, while the S&P 500 and Nikkei 225 both ended the week just short of record highs. US Treasuries continued to feel pressure though, with yields wider across the curve by a few basis points, more pronounced at the short end. Higher US Treasury yields are occurring in spite of odds (according to the CME FedWatch Tool) titling decisively now towards three 25bps reductions in the Fed Funds rate this year, one at each of the remaining FOMC meetings. This is a sharp change in two weeks, likely reflecting the combination of weak U.S. employment data (recall May and June payrolls were revised sharply lower) and the recent resignation of one of the FOMC voting members, Adriana Kugler. Ms Kugler will be replaced by Stephen Miran, Chair of the Council of Economic Advisors, certainly to be a third vote in favour of reducing interest rates at the next FOMC meeting (which was already expected). Keep in mind though that there is plenty of economic data coming before the next FOMC meeting, both economic / jobs data and inflation data.

You will find tables for the indices and asset classes tracked by EMC, updated for the most recent week, in the final section.

Bank of England lowers policy rate but not easily

Speaking of central bank meetings, the Bank of England lowered its policy rate (the Bank Rate) at its monetary policy meeting on Thursday, although it took two votes to push this through. There were four voting members that wanted to hold rates, four members that wanted to reduce rates 25bps, and one (Alan Taylor) that wanted to reduce the policy rate by 50bps. In the second round of voting, the Mr Taylor changed his vote to a 25bps reduction, sealing the 25bps reduction in the Bank Rate, to 4.0%. The difficulty that the Bank of England is facing is that inflation remains elevated, but the U.K. economy remains under significant pressure as far as growth, with the fiscal finances of the country also of concern to bond investors.

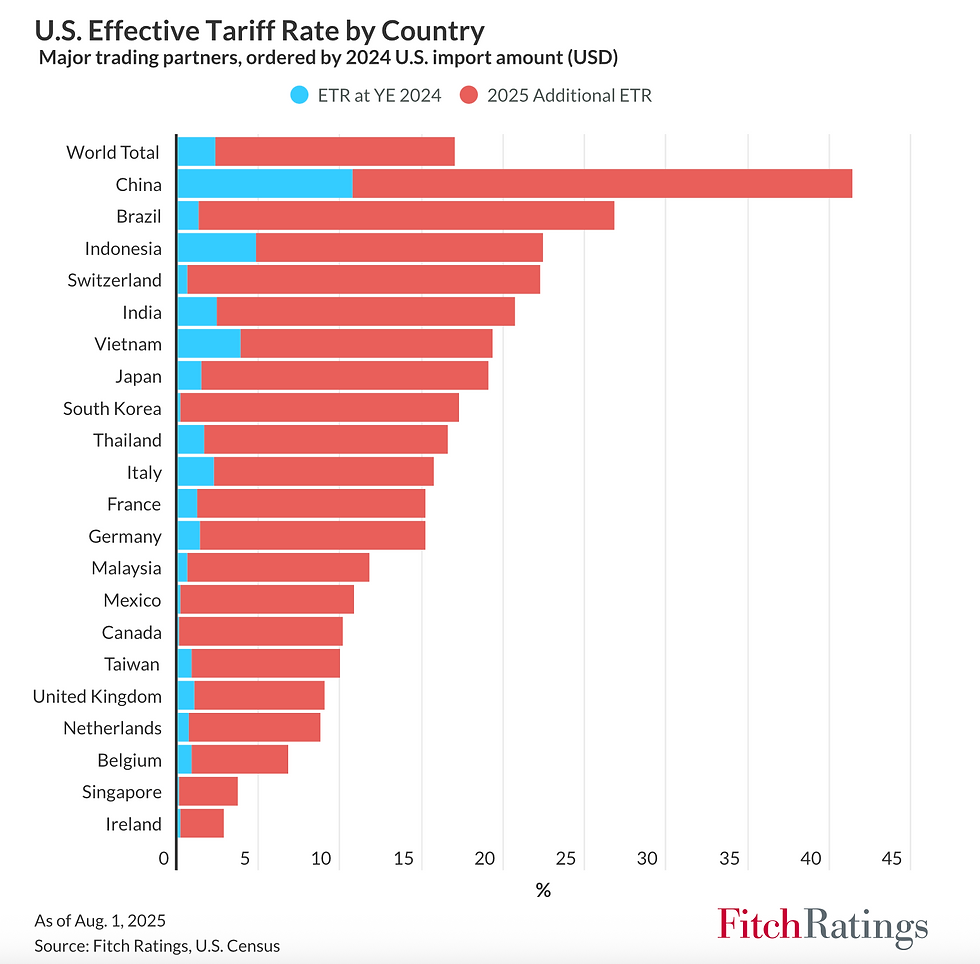

Fitch article regarding new August 1 tariffs

A short article from Fitch published recently discusses U.S. tariffs by country. The graphic below from that article compares tariffs by country at the end of December 2024 compared to the tariffs just announced by the Trump Administration on August 1.

The direction of travel of the effective (aggregate) U.S. tariff rate (world total, top bar) has been as follows according to Fitch:

End of 2024: 2.3%

Early April (“liberation day”): 25%

Late June: 14%

Effective August 1: 17%

Mr Trump, who has been labelled as TACO (“Trump Always Chickens Out”), has been steadier as of late. Arguably, his indecision and constant fluctuation in economic policies since his election has been equally as problematic as the actual policies, especially involving trade and tariffs. The timing of tariff implementation has also moved all over the place. Like it or not (and I don’t), now that tariffs seem to be largely fixed, removing the overhang of uncertainty seems to have soothed investors and further reduced volatility.

US stocks catch up with international stocks

Returns on US stocks have caught up with returns on international stocks. So much for the death of American exceptionalism, as U.S. corporate giants are doing better this earnings round that European companies. It all goes to show that diversification makes sense, especially since U.S. stocks remain priced for perfection. Even with erratic economic policies by this administration and the uncertainty that this creates for U.S. companies and their Boards, American companies have an uncanny ability to recognise the bumps in the road and navigate accordingly. It might make sense to lighten on US stocks, but history has proven it makes little sense to throw in the towel even with valuations elevated.

“Kiss the ring” – it worked for Apple stock!

On August 1, AAPL shares closed at $202.38/share, following rather lacklustre earnings for the recently-ended quarter. With the shares down nearly 19% YtD, CEO Tim Cook marched straight to Washington DC to suck up to President Trump. Not surprisingly, it worked! Mr Cook presented the president with a commemorative gift, and promised to spend another $100 billion in the U.S. on production facilities, on top of the $500 billion already promised. Even though this “promise” will not result in iPhone production moving on-shore for obvious economic reasons, the session soothed Mr Trump for the time being, along with AAPL investors. The shares closed the week at $229.35/share, up an astonishing 13%! It makes no sense to me, given the company’s sideways operating trends and valuation (28.9x forward earnings, 8.5x EV to sales). But as I cover next, retail investors simple do not care one bit about valuations anymore, or so it seems to me.

Fundamental analysis for stocks: a waste of time?

Yes it’s true – I am constantly asking myself if fundamental analysis matters anymore for stocks? I have doubts, because it seems that momentum pushes stock prices around (mostly higher) much more than company performance and valuations. This is especially true in the U.S. Because of this false state of mind, I believe that a much better indicator of the state of the U.S. economy and direction of travel is the US Treasury bond market, certainly the “adult in the room”. The bond market is a large, liquid, global market driven by institutional investors, and it is this market that carries more truth about the future. The bond market is providing mixed messages at the moment, with yields remaining elevated even though it is increasingly clear that the U.S. economy is weakening. This means that concerns regarding a slowing U.S. economy are being usurped by the combination of higher long-term inflationary expectations and conscience diversification by international investors to reduce their holdings of (and reliance on) US Treasuries and the US Dollar. Whether long-term inflation concerns are a result of tariff-related inflation, growing U.S. deficits, or some combination of both, is hard to say.

Anthony Scaramucci interview on “Pivot”

Lastly, I recently listened to an interesting podcast on the New York Magazine’s podcast “Pivot”, featuring Anthony Scaramucci. He was interviewed for over one hour by Kara Swisher, one of the co-hosts of Pivot, and you can find the video version of this interview on YouTube here and the audio version on Spotify here. For those of you that don’t know Mr Scaramucci, he is a rather controversial figure, a former banker and now a hedge fund manager at his own firm, Skybridge Capital. However, he might be better known for serving as the Communications Director in the White House in 2017 during Trump 1.0 and was sacked by Mr Trump after only 10 days. Naturally, he has some rather interesting insights into the president, his behaviour and his team. If you are a Trump / MAGA supporter, do not listen to this because it has some insights that you might not enjoy hearing. If you are more open-minded though, you might find the podcast interesting albeit you have to keep in mind that it is a show that leans left and Mr Scaramucci remains rather controversial.

Market summary / tables

_________________

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Comments