Week ended Aug 1, 2025: more trade uncertainty, weak jobs report

- tim@emorningcoffee.com

- Jul 31, 2025

- 6 min read

Updated: Aug 2, 2025

The first four days of this week had a vibe that is similar to the one that we have been experiencing in markets now for several weeks running.

Earnings were fine (with META and MSFT exceptional, and AAPL surprising to the upside),

Economic data trickled in suggesting that the U.S. economy remains solid,

The FOMC (and BoJ) didn’t budge, and

Uncertainty regarding the next move(s) in the trade war continues, with President Trump announcing new tariffs to be effective today (August 1)

With this backdrop, investors still said “meh” for much of the week, remaining full-on committed to anything with even a sniff of risk. However, it appears that the “new” U.S. tariffs to be imposed starting today have sent stocks lower in Asia, along with futures in the U.S. and Europe. The US Treasury bond market has been a touch better so far this week in spite of the Fed’s decision to hold its policy rate intact, even with hawkish rhetoric from Chairman Powell during the post-decision commentary. The highlights of the week so far are below. The market update will follow tomorrow.

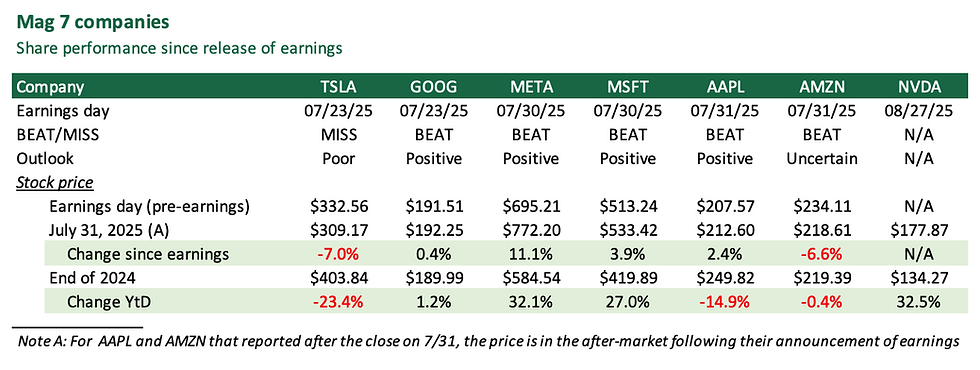

Earnings: Nearly one-third of S&P 500 companies reported earnings this week, and the results overall “felt” mixed to slightly positive. Investors were largely focused on four of the infamous Mag 7 companies that reported on Weds and Thurs: META, MSFT, AAPL and AMZN. META and MSFT served up very strong results and favourable outlooks (albeit including higher capex on AI), AAPL surprised on the upside with better-than-expected growth in iPhones, and AMZN also delivered strong results but was cautious about the outlook, sending their shares lower in the after-market. The table below summarises the performance of Mag 7 stocks so far during this earnings season.

FOMC and Bank of Japan decisions: Neither the FOMC (press release here) nor the BoJ served up a surprise, as both held their policy rates intact.

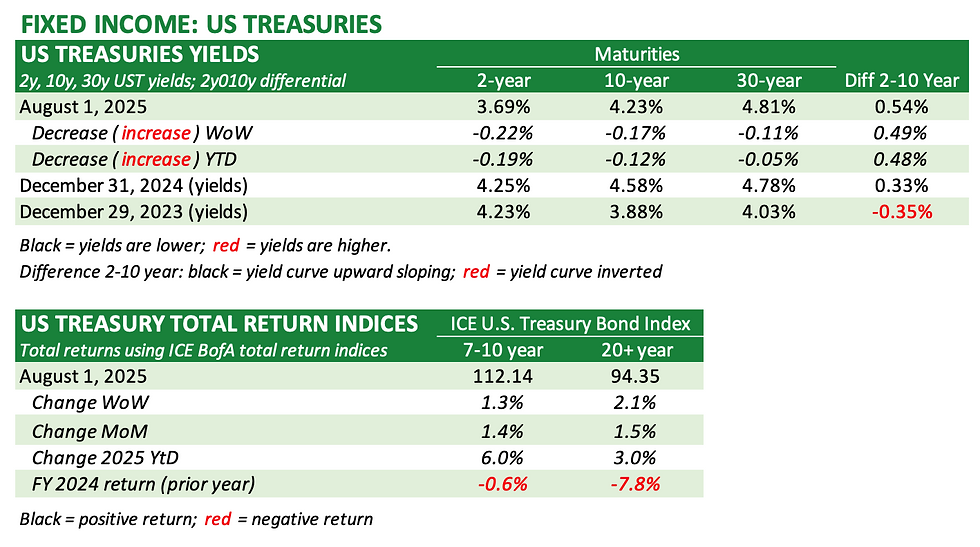

FOMC (U.S.): Pundits seemed to believe that Mr Powell’s press conference had a hawkish overtone even though there were two dissenting governors at the FOMC meeting which voted to lower the Federal Funds rate at the meeting. The Fed chairman was far from committal regarding a policy rate reduction at the next FOMC meeting in September, sure to infuriate the president. The US Dollar strengthened during the press conference, stocks fell although they largely recovered by the close, and US Treasury yields were under some pressure, too. The decision was not a surprise to investors in light of the rather solid U.S. economic data that appeared during the week, although Mr Powell’s hawkish comments probably were. The CME FedWatch Tool reflects the Fed’s view at the moment, as a reduction in the Fed Funds rate has been pushed to October (from September), with only one reduction (rather than two) pencilled in for the remainder of 2025.

BoJ: Recall that the BoJ is heading the other direction than most developed markets central banks as it seeks to normalise its dovish monetary policy by raising its policy rate. However, with uncertainty rampant because of volatile U.S. trade policies (even though a framework agreement between Japan and the U.S. has been announced), the BoJ stood still as expected. Equally important, investors believe that the BoJ signalled that no further increases in the overnight policy rate are likely in 2025.

Economic news that mattered:

U.S. 2Q2025 GDP came in better than expected at 3.0% YoY, although the figure is somewhat nuanced in that imports – which accelerated in the first quarter due to tariff uncertainty – reversed course. (Lower-than-expected imports boosted 2Q25 GDP.) For reference, 1Q2025 GDP was negative 0.5%, and consensus expectations for 2Q2025 GDP was 2.3% YoY. The BEA press release is here.

PCE for June (the Fed’s preferred measure of inflation) was slightly higher than consensus expectations, with headline PCE coming in at 2.6% YoY (up from 2.4% YoY for May and higher than 2.5% YoY consensus), and core PCE coming in at 2.8% (flat to May). Note that both measures remain above the Fed’s inflation target of 2.0%/annum, one of the reasons that the Fed is not in a hurry to reduce its policy rate or make other accommodative changes to its current policies. The BEA press release is here for June’s PCE.

July jobs report: The payrolls report is discussed further below.

Trade war / tariffs: The trade war escalated again with President Trump announcing new tariffs on a host of trading partners that are effective today. The tariffs are below those that were presented on “Liberation Day”, but nonetheless push aggregate U.S. tariffs to the highest (17.3%, post-adjustment of imports due to new tariffs) since 1935 according to the The Budget Lab at Yale. As an aside, the July 27 update from The Budget Lab at Yale is an excellent resource for understanding tariffs and their likely effects on trade patterns and the economy.

IMF revised projections: The IMF revised its projections for global growth up slightly as the trade war continues but with less negative economic effects apparently. You can find the IMF report at this link. Below are the introductory comments, which summarise succinctly where the IMF stands at this point.

“Global growth is projected at 3.0 percent for 2025 and 3.1 percent in 2026, an upward revision from the April 2025 World Economic Outlook. This reflects front-loading ahead of tariffs, lower effective tariff rates, better financial conditions, and fiscal expansion in some major jurisdictions.

Global inflation is expected to fall, but US inflation is predicted to stay above target. Downside risks from potentially higher tariffs, elevated uncertainty, and geopolitical tensions persist.

Restoring confidence, predictability, and sustainability remains a key policy priority.”

July Payrolls report: Although Mr Trump’s tariff announcements on Thursday evening filtered through markets on Friday, negatively affecting risk sentiment, things worsened further following the release of the July jobs report on Friday morning. Nonfarm payrolls increased less than expected, and the unemployment rate moved slightly higher to 4.2%. However, what rattled markets more was the revision to May and June payrolls data, with new jobs added revised sharply lower vis-à-vis what was reported earlier. You can see the trajectory in the jobs market in the graph below from #CNBC.

The payrolls report is often revised, but this report firstly will most certainly improve the odds of a Fed Funds rate cut in September, barring an unexpected increase in inflation, and secondly, has cost the head of the BLS her job because the figures were revised lower, suggesting a weaker economy than had been thought. You can think what you want, but sacking the head of an economic statistics agency because of a report that is unfavourable to the existing administration might happen in a banana republic, but not in a developed market like the U.S.A. Mr Trump’s tactics are absolutely appalling and completely wrong, further exposing the fallacies of his economic policies generally (and trade policies specifically) and undermining the integrity of U.S. economic data on which investors make important investment decisions. I view this as an inflection point, and suspect things will only worsen from here. What a sad day for America and the great American economy.

MARKET UPDATE

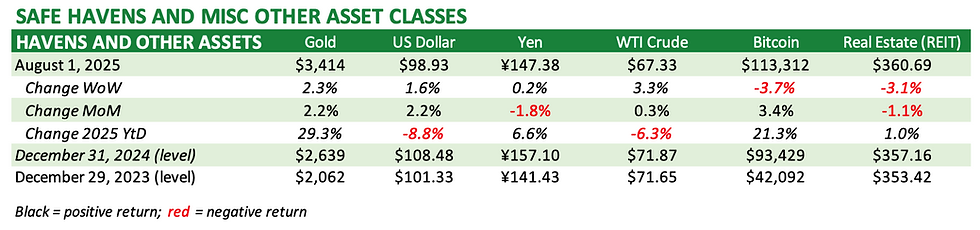

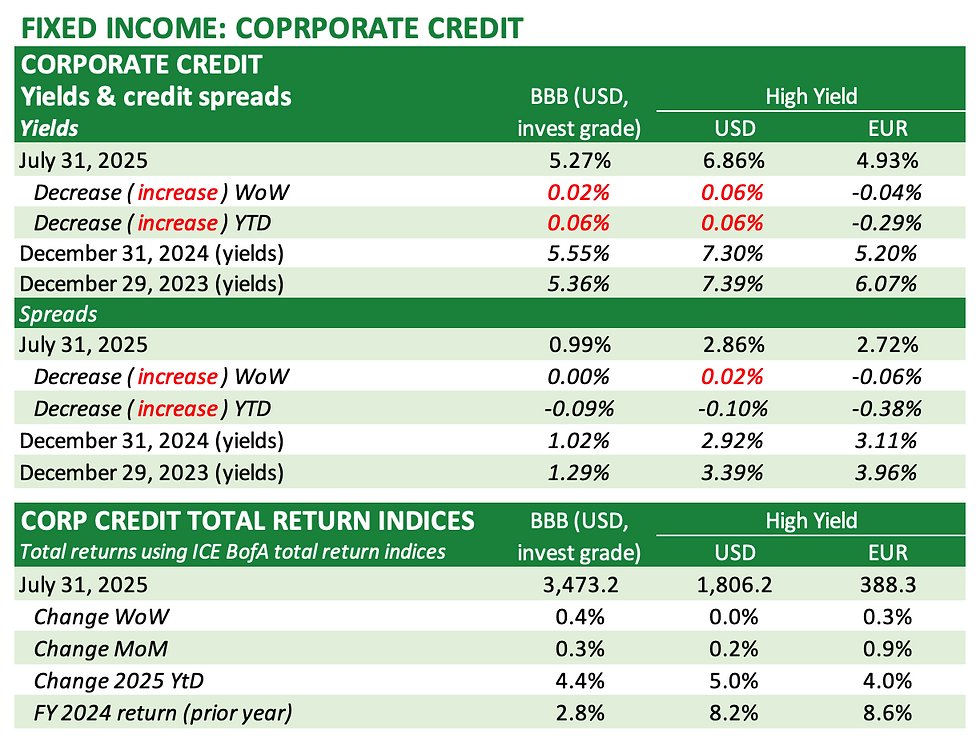

In a week in which we drifted sideways for much of the week, Friday turned out to be an inflection point. It was a “welcome to reality” day as investors finally seemed to buckle under the pressure of Mr Trump’s new tariff announcement for a host of countries, along with the release of the July jobs report which suggested that the U.S. jobs market is much weaker than had been thought. I suppose this is not surprising given than companies have largely been behaving like deer in headlights, uncertain as to exacrtly what to do as they digest the president’s highly volatile trade policies, with tariffs announced, deferred, revised, withdrawn, reannounced, etc. Sooner or later, this had to bite, and we are starting to see the early effects. Risk assets sold off across the board, with safe haven assets like US Treasuries and gold rallying.

The weak payrolls report does provide the president with more ammunition to “encourage” the Fed (by bullying Mr Powell, how childish!) to lower the Fed Funds rate in September. Of course, this assumes that inflation does not rear its ugly head, but time will tell. It is hard to say if this risk-off sentiment is the beginning of a new trend down, or – as has often been the case – Mr Trump will think better of the uncertainty his policies have introduced as far as companies and investors, and decides to reverse course. I am not expecting a bounce, simply because the market is already over-bought and the administration’s policies are undoubtedly weakening the U.S. and global economies, and undermining investors’ confidence in the U.S. capital markets.

Below are updated tables for the week just ended.

*** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Comments