Week ended Nov 7, 2025: Dip, or beginning of the end?

- tim@emorningcoffee.com

- Nov 8, 2025

- 5 min read

There are no shortage of investors which think stocks are well over-baked, especially stocks of companies that are directly or indirectly associated with the ongoing A.I. hype. It has appeared for weeks that this was nothing more than scaremongering as stocks continued their stratospheric rise. However, the past week saw scepticism start to set in as investor concerns regarding valuations broadened. Tech stocks led the sell-off, although there were few places to hide as most global stock markets got a healthy – and arguably much needed – dose of reality. Buy-the-dip buyers did their best to ride to the rescue mid-week in the U.S., but the rally faded rather quickly. As the selloff in US stocks accelerated at the end of the week, investors sought traditional safe haven assets including US Treasuries and gold. Heightened risk in the global markets also spread into corporate bonds, with spreads – especially (and certainly not surprisingly) in the weaker high yield universe – widening sharply during the week. The VIX index, a measure of U.S. equity volatility, rose back above 20 during the week, as investors try to figure out what might happen next.

Stocks wobble led by fading A.I. narrative

The combination of retail buying of any and everything that can somehow “touch” the A.I. narrative and rampant short covering has led to rather insane valuations in many tech stocks. It looks like some common sense might be finally setting in. Even those companies that posted impressive results for the prior quarter and offered encouraging forward guidance were suddenly more intensely scrutinised from a valuation perspective. In some cases, it’s about A.I. investment. Look no further than META’s quite decent (recurring operating) results (here). META investors puked on the substantial but somewhat vague increases in A.I. spending espoused by founder/CEO Mark Zuckerberg. Palantir (PLTR) is another stock that has ridden the A.I. boom, with retail investors – similar to TSLA diehards – pushing the stock to absurd valuation levels. Even though PLTR served up fantastic earnings (here) and raised its forward guidance, the shares got hammered. Can anyone be surprised that gravity finally pulled PLTR lower given that the company’s stock is trading at 137x sales and 217x forward earnings? Let’s be clear – this isn’t a reflection of the company’s operating performance which has been amazing. The Economist – recognising the silliness of the meme-like valuation of the company – just published a very balanced article: “Why Palantir’s success will outlast AI exuberance: Its valuation looks bonkers, Its business isn’t”. Certainly Michael Burry, who minted dosh during the GFC with his short bets on subprime mortgages, thinks he smells an A.I. over-shoot. His firm (Scion Asset Management) announced last week that they had bought put options on 5 million shares of Palantir and 1 million shares of NVIDA, betting in both cases that the shares are over-valued and would fall in price. That investment looked very smart by the end of the week.

Stocks are richly valued even according to Wall Street CEOs; “prepare for drawdown”

Goldman Sachs CEO David Solomon and Morgan Stanley CEO Ted Pick both warned of a likely stock market correction of 10% to 20% at the Global Financial Leaders’ Investment Summit in Hong Kong early last week. You can read more about their comments on finews.asia website or #CNBC here.

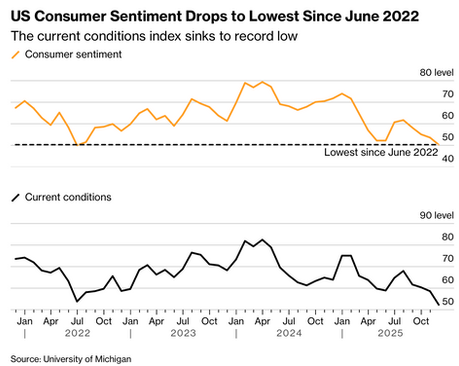

U.S. consumer sentiment worsens further, near lowest on record

Consumer sentiment continues to worsen in the U.S. according to the University of Michigan Consumer Sentiment Survey released Friday. The two graphs below spell out the trend, as consumers worry more about the future economic outlook and jobs market, both of which are undoubtedly being splattered by the ongoing shutdown of the U.S. government.

Other things that mattered last week

The Bank of England held its policy rate constant at its monetary meeting on Thursday in a close decision, but opened the door to a further 25bps reduction at the next (and last) meeting of the year in December.

The US government remains closed with no end in sight. The cost to the US economy, according to a #Bloombergarticle, is around $15 billion/week, and could reduce 4Q2025 by up to 2% depending on how long the shutdown continues.

The legality of President Trump’s tariffs are being considered by the US Supreme Court, with the body language suggesting that tariffs imposed by Mr Trump under the International Emergency Economic Powers Act (IEEPA), are likely to be struck down. It appears most of the justices agree that tariffs are essentially a tax, and this authority rests solely with the Legislative Branch (i.e. Congress), not the President. Apparently, a decision might not be made before early 2026.

Over 90% of S&P 500 companies have now reported earnings for their most recent quarter, and the results have actually been very encouraging even though valuations are stretched. You can find a good summary at #FactSet’s weekly update here: “Earnings Insight for the Week Ended Nov 7 2025”.

Friday was jobs report day in the U.S., but the October job’s report – normally released by the #BLS on the first Friday following the end of the month – was not published since the government remains shut down. According to various articles I have read using private sector data, the view seems to be that the U.S. jobs market is not dramatically worsening, but that companies are in a “low fire, low hire” mode.

Markets

The theme of the past week was clear as global stocks, led by the lofty U.S. indices, took a breather. Is this the beginning of the end or just another “buy the dip” opportunity for retail investors? U.S. stocks did stage a rally mid-week following a couple of poor days, but the rally did not prove sustainable as stocks resumed their fade. To look at the week from an optimist’s perspective, stocks did bounce off their mid-session lows on Friday, and the VIX went from 22 to close the day at 19. Perhaps this is setting the stage for recovery next week. The other market that was caught in the downdraft is the U.S. corporate bond market, with spread widening accelerating as the week wore on. High yield spreads (USD) widened by 19bps WoW. As we have seen time and time again, U.S. stocks in particular seem very resilient. Investors hope that this selloff does not reflect a wholesale change in sentiment, but rather is nothing more than a bad week with an unusual blip. Even though risk appetite seemed to fade, there was no dramatic rush into traditional safe haven assets like gold or US Treasuries, both of which ended the week flattish.

Below are updated tables for the week ended November 7, 2025.

_________________

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Comments