Week ended Jan 30, 2026: A new Fed chair is chosen

- tim@emorningcoffee.com

- 3 days ago

- 4 min read

Updated: 3 days ago

We remain in a rather strange market environment, one that remains highly unpredictable and volatile. In fact, it’s hard to find the right words to describe this past week. Stocks powered forward early in the week, as did gold and silver. Yes, you are reading correctly – stocks and gold (and silver) all rallied hard at the beginning of the week, continuing to breakdown the historical negative correlation between risk assets like stocks and risk-off/safe haven assets like precious metals.

S&P 500 earnings – focus on four Mag 7 companies

U.S. stocks flatlined more or less mid-week as more S&P 500 companies, including four of the infamous Mag 7 companies, delivered generally good earnings, although several companies also announced concurrent job reductions. Further concerns resurfaced regarding the ROI on A.I. spend, especially involving MSFT, which was the worst performer among Mag 7 stocks last week as investors saw signs of (slightly) slowing growth in cloud and ongoing huge capex needs to finance the construction of data centres. TSLA continued its dismal growth trends in its core business, although Mr Musk continues to spin the narrative of autonomous vehicles and robots, which his faithful followers latch onto – with no questions asked – like he is the Pied Piper. META fared the best following their earnings, serving up strong growth across its various social media platforms, with investors looking past their ever-growing capex needs to construct data centres,. APPL delivered surprisingly good results on Thursday attributable largely to much-better-than-expected iPhone 17 sales, along with solid revenue growth in the computer giant’s services sector. However, AAPL is richly valued which – aside from meme TSLA – makes it vulnerable even following strong results. The table below is an update of the Mag 7 companies, including price action the past week and since the beginning of the year, and current valuation metrics.

For a more macro view of S&P 500 earnings this quarter, please see “This Week in Earnings” or “Earnings Insight”.

Fed delivers a big “nothing burger” as expected

The Fed delivered exactly as expected, holding the Fed Funds rate at its current level. Following the decision, Chairman Powell – the adult in the room – sidestepped numerous questions from the financial press regarding the frivolous DoJ suit spearheaded by Mr Trump. There was no real news in the Fed’s policy decision to hold the policy rate constant. You can read the FOMC policy statement here. As it stands, the CME FedWatch Tool continues to project two 25bps reductions in the Fed Funds rate in 2026, with the first one expected in June.

….and we have a new Fed chairman nominee

With all the fanfare like on “The Apprentice”, Mr Trump finally announced his much-anticipated choice for the Fed Chairman role, Kevin Warsh. Of course, pundits seem to be all over the place on Mr Trump’s choice, but Mr Warsh looks like a reasonable choice to me. Mr Trump wants someone in the position that adheres to his philosophy of the lower interest rates, the better, inflation be damned. But I believe based on Mr Warsh’s long past (as opposed to just the last year or so, when sucking up to the President was the path to the Fed chair job), he looks well-equipped to handle this position. Investors need to remember that in any event, the FOMC is a 12-person committee, and outlying views by committee members – while newsworthy – aren’t really worth much. The market reaction was mostly neutral, although investors sold the long end of the US Treasury curve, and positioning around the debasement of the US Dollar collapsed because Mr Warsh does have a history of caring about inflation. The side-drama of course is that Senator Thom Tillas (R, NC), a member of the Senate banking Committee, will not confirm Mr Warsh or any other new Fed chair until the current DoJ investigation of Mr Powell and the Fed is completed. It’s so nice to see someone with balls occasionally show up in Congress.

MARKETS LAST WEEK

U.S. stocks were volatile last week although the S&P 500 still managed to eke out a gain of 0.3% for the week. It sure didn’t feel like it though! European and emerging markets stock indices outperformed U.S. market indices again; Asian markets generally lost ground. The U.S. Treasury curve steepened during the week, slightly more after Mr Warsh was chosen to be the new Fed Chairman (s/t Senate confirmation). Rates were lower at the more policy-sensitive short end of the curve, but were higher in the belly and long end of the curve. The volatility in precious metals made the volatility in stocks look tame, with the price of gold and silver both surging mid-week, only to collapse on Friday as the Dollar debasement trade weakened. The greenback notched gains after losing ground early in the week, with Treasury secretary Bessent saying that a strong dollar is important to the U.S. economy, just after Mr Trump gave the dollar a “meh” review. Also, rumoured intervention in the Yen market pushed the Yen higher, although any sort of coordinated approach to strengthening the Yen remains hearsay for now. Bitcoin got pummelled again, sinking below a key support level of around $88,000 to close at $xx,xxx.

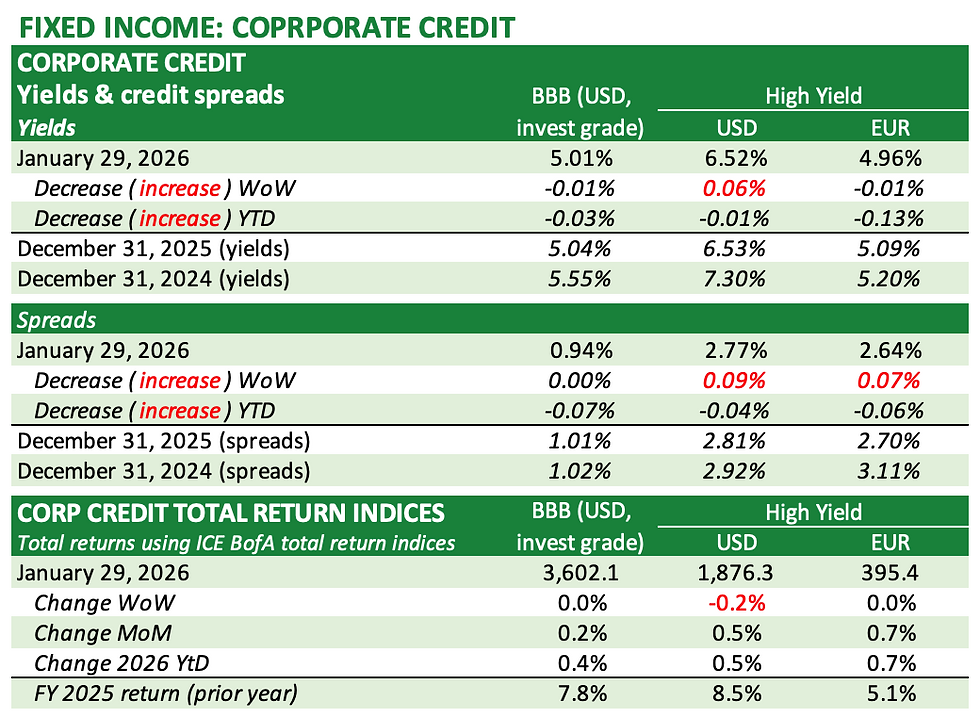

The tables below have been updated for the end of the week

_________________

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Comments