Week Ended Dec 11th 2020 and the Week Ahead

- tim@emorningcoffee.com

- Dec 12, 2020

- 9 min read

The Week Ahead

Discussions drag on and on about both a new US fiscal stimulus plan and a post-BREXIT UK-EU trade agreement, with the former likely to surface at some point, but the latter looking less and less likely. In fact, the most recent deadline of many for a post-BREXIT trade agreement will pass on Sunday, and this one seems firm. Regardless of the outcome, the UK will be entering a new world with all sorts of turbulence come January 1, 2021, and I don’t even want to think about it. Following the ECB’s policy statement and massive boost to its QE programme this past week, the Fed, BoE and BoJ will all follow suit and will be releasing policy statements this coming week. The expectation is that interest rates will remain on hold and QE will continue (without an increase) in all three countries as economic growth slows due to the pandemic. This week might be the last active week in the financial markets before liquidity begins to fade and the Christmas lull sets in. With this backdrop, I suppose you have to stay mostly long equities, although I’d be selective and avoid the very expensive momentum names, and also stick with corporate credit (bonds). Having said this, I think equities and corporate bonds are richly priced, but there’s simply nowhere else to go to get any real return. Also, I suggest keeping some cash on hand. The reason is that it feels to me like risk-on sentiment is about as strong as it could be, so I have a natural bias towards the downside. Investors might even want to use this opportunity to take money off the table as the year winds down, crystallising gains never thought possible in the first several months of the year as the pandemic spread havoc around the world.

Summary, What Happened Last Week (details below)

Perhaps the best news of this past week is that the U.K. became the first country in the developed world to begin vaccinating people against COVID-19 (using the Pfizer-BioNTech vaccine), and rollout in the US is likely to begin this coming week following FDA approval yesterday. The bad news is that the market feels increasingly fragile. US economic data is getting weaker as the recovery slows and the pandemic continues to rage in the US and Europe. More people died in one day in the US from COVID-19 on Wednesday than died in the World Trade Towers terrorist attack, to provide some understanding of how grave the situation is at the moment. There is still no BREXIT deal, and both the UK and EU feel on edge. The ECB expanded its QE programme and finally got some concurrent fiscal relief (pending, mid-2021) as the €1.8 trillion budget, including €750 bln earmarked for coronavirus relief, was approved by all member states. Similar to the seemingly never-ending post-BREXIT trade discussions, Congress remains unable to agree a new fiscal stimulus plan in the States as the final provisions of the CARES Act are set to expire. Having said all of this, markets don’t seem to care, at least not much – IPOs for DoorDash and AirBnB both skyrocketed from their IPO prices, just one illustration of how gobs and gobs of central bank liquidity is making nearly all asset classes fly. Equity and credit markets have plenty of reasons to weaken, but the reality is that they are showing amazing resiliency in the face of plenty of bad news and rather absurd valuations in some cases. As difficult as it might be to digest, this sort of environment is the one in which people must become accustomed to investing. Lastly, I wrote an article early last week on Presidential pardons, and in case you missed it, you can find it here: "Pardon Me."

Global Equity Markets

Equity markets in the US and Europe faded into the end of the week. It’s hard to say if this was caused by the raging pandemic and disappointing economic news, or simply fatigue after a very solid run since late October. As a potential signal of where we might be heading in the US equity markets, it is worth noting what happened this past week in Europe. The combination of the ECB upping its QE programme and the agreement (finally) amongst member states of the EU of a €1.8 bln fiscal budget brought little joy to the European equity markets, with the STOXX 600 still falling 1.0%. If we look at the US markets, it is hard to tell what is already “priced in” as far as a potential new fiscal stimulus package, but I suspect it is being largely anticipated. Here is the summary of this performance this year of the indices I track.

Although equity markets slumped at the end of the week, investors were largely focused on four companies during the week: Tesla, Disney, DoorDash and AirBnB. Let’s focus first on the week’s two red hot IPO’s, DoorDash (DASH) and AirBnB (ABNB). DoorDash sold 33 million shares at $102/share on Tuesday evening, above the top of the last indicated range ($85-$95/share), raising $3.4 bln and valuing the company at around $37 bln (fully-diluted). The food delivery / logistics company, which started in 2013, is the market share leader in the US in the food delivery business but has never made a profit. The shares skyrocketed after the listing, closing the first day at $189.51/share (+86%). This pushed the company’s market value to $69 bln (31.1x revs), below Starbucks (SBUX, $120.9 bln market cap, 5.1x revs) but above Chipotle (CMG, $36.4 bln market cap, 6.4x revs). One VC firm that has to be thrilled with this outrageous valuation is the Softbank VisionFund, which is ever so slowly clawing back the severe losses it had from write-downs just after the pandemic started. On Thursday, AirBnB followed the lead of DoorDash, selling 51.6 million shares at $68.00/share, above the last indicated range of $54-$60/share. The company raised $3.5 bln. Similar to DASH, ABNB shares skyrocketed on their debut, closing the day at $144.71/share (+113%), pushing the company’s market cap to nearly $95 bln, well more than Booking.com, Expedia and Marriott, for example. I will write more about these two companies early next week.

Tesla (TSLA) took advantage of its higher-by-the-day stock price to announce a new share offering early last week. After closing at over $640/share on Monday, TSLA announced that it would be raising $5 bln in equity over a period of time through gradual sales. This is the third equity offering this year for the high-flying EV company, which – as an aside – closed at $609.99/sh on Friday (market cap of $578 bln, 21.6x LTM revenues). Importantly, this offering buys the company more time because its cash position must be between £18 bln and $20 bln pro forma.

Lastly, I feel compelled to mention Disney (DIS), simply because of the transformational nature of the company during what has to be the most tumultuous year in the Disney’s history. It is unfair to say the company has reinvented itself, because it has the same assets as it did one year ago. However, rather than leading with its historical cash cow businesses like theme parks and films, it has transformed into a very successful (albeit not profitable I understand) streaming company with an amazing catalogue of content. Following the Disney Investor Day on Thursday, the shares reached an all-time intra-day high of $179.45/sh on Friday before settling on the day at $175.72/sh (market cap of $318 bln, 4.3x LTM revs). What makes this all the more amazing is that the shares got absolutely hammered early in the pandemic along with other travel & entertainment peers, reaching an intra-day low of $81.09/sh on March 23rd. In essence, DIS has moved from a more traditional value stock to a relatively successful momentum play.

Credit Markets

Corporate credit spreads were more or less stable this week across investment grade and high yield, as the USD corporate bond market remained at or near record-low yields. The overall tone remains constructive. New issue volumes in the USD corporate bond market will be the highest ever in 2020, as companies rushed to take advantage of record-low yields since 2Q2020, thanks to the Federal Reserve’s massive buying programme.

Safe Haven Assets & Oil

All of the safe haven assets were better bid on the week as the equity markets were slightly weaker. The yield on the 10-year US Treasury fell to 0.90% (-7bps w-o-w), as prices of US Treasuries firmed across the curve. Gold was stronger on the week, settling Friday at $1,839.85 (+0.5%), whilst both the Yen and the US Dollar were very slightly better. WTI oil closed at $46.57/bbl (+1%), continuing the positive run as investors look ahead to greater demand following the eventual end of the pandemic.

Economics & Politics

I highlighted a number of economic and political flashpoints in last week’s update. As of the time I am writing this update, some of the key flashpoints have not changed. A post-BREXIT agreement is looking increasingly unlikely barring both sides softening their inflexible stances on a few key issues, and it seems we are no closer to another round of fiscal stimulus in the US even though the final features of the CARES Act are about to expire, just at the height of the new wave of the pandemic. Adding to this are more signs of a weakening US economy, and the threat that both the US and Europe might face further shutdowns as the pandemic accelerates. With vaccines now beginning to be administered, I understand the long game, but I find myself very much stuck in the moment, and it is increasingly dire.

The ECB announced on Thursday that it would leave interest rates unchanged and vastly expanded the amount and duration of its quantitative easing programme (increased €500 bln to €1.85 trillion, to March 2022) and its bank lending (LTRO/TRLTO) programmes, amongst other revisions. You can find the details in the ECB press release here. Also, the EU managed to finally reach agreement on its €1.8 trillion budget for the coming year, which includes the targeted and unique €750 bln coronavirus stimulus plan. This wasn’t enough though to shore up the fragile markets in Europe, as the ECB nears its potency and the fiscal plan is – at the earliest – a mid 2021 event.

US employment figures disappointed on Thursday, with 853,000 Americans filing for first-time unemployment claims, versus the consensus expectation of 725,000. This also represented a rather significant increase over first-time claims from the prior week of 712,000 and was in fact the highest number of first-time filers since the beginning of October. It is clear that the US economy is losing steam as it remains burdened by the growing pandemic. We ended the week with no agreement in Congress on a new fiscal stimulus plan, also weighing on investor sentiment.

Yet another week ended without a post-BREXIT trade deal, with both the UK and EU signalling that a deal now looks difficult. There is (another) self-imposed deadline of Sunday, so should this stick – and it would be the first deadline to do so – it will mean either we have a deal or not when the markets open Monday. Deal or no deal, there will most certainly be chaos in January as both the UK and EU adopt to the new reality of an EU without the UK as a member.

There is a boatload of economic data coming next week, perhaps the last meaningful week of the year in terms of hard data. In the US, we will get price, capacity utilisation, retail sales, home sales and unemployment figures, amongst other data, and the Fed will release its FOMC notes mid-week, followed by a press conference. The UK will release a similar litany of data, and the BoE will release the minutes from its last policy meeting on Thursday. Manufacturing and services data for November will be released in the Eurozone next week, as well as from the bloc’s two largest members Germany and France. There is also capacity and manufacturing data coming from Japan next week, with the BoJ releasing its latest report followed by a press release (on its monetary policy) on Friday.

COVID-19

US deaths from COVID-19 have passed 3,000 in a single day, which happened on Wednesday. To put this in context, more people died on that one single day from the coronavirus than died from the terrorist attacks on the World Trade Center in 2001. The difference, of course, is that deaths from COVID-19 are occurring day after day in the States, and the number of deaths and illnesses – and consequently the capacity of hospital beds – is rising rapidly. New York banned indoor dining effective Monday, a blow to the thousands of restaurants in New York City that are teetering already on the brink of failure.

Europe is also worsening, albeit perhaps not as rapidly as in the US, but certainly enough to inspire further lockdowns if needed. It is increasingly feeling like there will be more severe

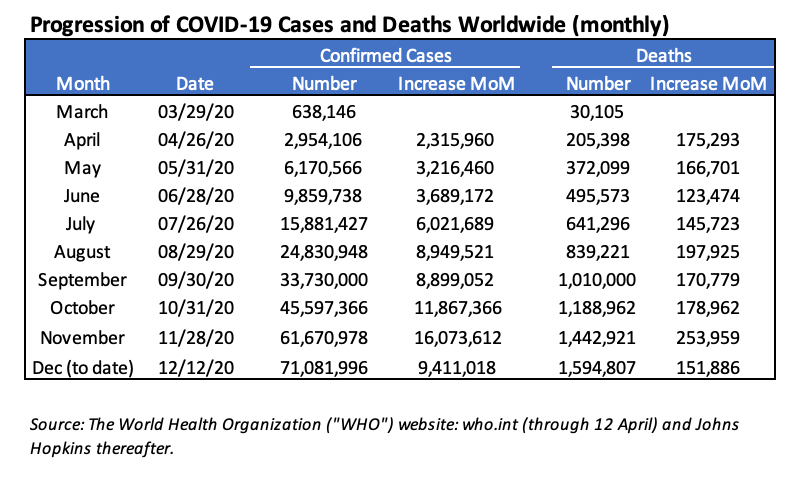

restrictions coming soon, with the only real question being “will these come before or after the end of the year?” To the right is the updated table showing the monthly progression of cases and deaths. Last week, there were around 5.2 million new cases globally and just over 76,000 deaths from COVID-19.

Focusing on the good news, the end might be in sight as vaccines roll out. The first person to receive a vaccine in the UK occurred on Tuesday, and the F.D.A. approved the use of the Pfizer-BioNTech late on Friday, with the rollout in the US expected to begin this coming week with a target of 3 million doses. The Trump Administration’s targets I read were 25 million doses by the end of December and 100 million doses by the end of March, which would be terrific milestones if they can be achieved. Even so, I continue to believe that it is the 3Q2021 before things really begin to normalise.

**** Follow emorningcoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Comments