Week Ended November 26th, 2021

- tim@emorningcoffee.com

- Nov 27, 2021

- 7 min read

“Here’s the key to understanding risk: it’s largely a matter of opinion.” Howard Marks, The Most Important Thing Illuminated: Uncommon Sense for the Thoughtful Investor

The best thing I can say about last week is “I’m glad it’s over!” What started with ongoing worries about inflation ended with concerns around a new and apparently nastier COVID-19 variant, now referred to as Omicron. The reality is that financial markets were at a tipping point anyhow, and the last thing investors needed was a stark reminder that this pandemic is far from over. However, we got just that on Friday as all eyes turned towards this new variant now present in South Africa and a few other African countries, which will almost surely invade all corners of the world in the coming weeks. If you want a quick summary of this new variant, the BBC covered it concisely and well in an article here. And since COVID-19 is back at the centre of the news flow, you might be interested in an update on the trajectory of the pandemic, which you can find on Bloomberg here: “Mapping the Coronavirus Outbreak Across the World.” I had stopped tracking the evolution of COVID-19 in the weekly update on the basis that the world had gotten used to it, but clearly, this thing will simply will not go away.

Nothing about a new variant sounds good to me, especially as winter quickly approaches. Mutations of COVID-19 are not unusual – as we have been told from the onset – because until the virus is completely eradicated (if ever), it will continue to mutate to evade immune systems, navigating around immunity defences whether gained naturally or through vaccinations. Since pandemics aren’t my forte though, let’s return to financial markets. For me, Black Friday was not only about the news of a new variant, but

also the confluence of warning signals (like inflation) – alongside nose-bleed valuations – that seemed to suddenly stop investors in their tracks. Once again, those investors that are long equities are beholden to the “buy-the-dip” community, as hopefully these investors will swoop in and put a floor under prices. Just one request – please hurry up! They say a picture says a thousand words, and this graphic to the left of the VIX (otherwise known as the “fear index”) spiking on Friday says all you need to know!

If you can think back only a few days, before news of the “new variant” moved to the front page, the US economy was continuing to spit out economic data that suggested that the inflation genie was completely out of the bottle. US personal outlays came in well ahead of consensus expectations for October, at 1.3%, suggesting that consumers are spending bigtime (press release from BEA is here). This will keep pressure on prices (a.k.a. “inflation”) for the foreseeable future, as these pressures are demand-driven. The weekly US jobless claims report also pointed towards an on-going robust recovery, with new claims coming in at a scant 199,000 for the week, the lowest level since 1969! And as further indication of an economy that has recovered, continuing claims fell to the lowest level since the onset of the pandemic (see Department of Labor press release here for the details). This sort of economic data flow continues to suggest that the Federal Reserve is behind the curve as far as its well-articulated path towards tightening. Mix all this together, and you get a recipe for bonds getting trashed, which is just what happened, that is until inflation concerns were overtaken in a matter of minutes (or so it felt) on Friday by concerns about Omicron. This new variant suddenly filled investors with fear, and they ran for the cover of safe haven assets on Friday following the Thanksgiving holiday break. The bid for risk assets completely collapsed, and safe haven assets rallied across the board. It’s been a long time since this theme was a driver of market sentiment. Lost in the muddle was the price of oil, which had been under pressure a few weeks anyhow. Oil prices had stabilised as a US-led “OPEC+ counter-coalition” announced a coordinated release of oil from their strategic reserves early last week (1). OPEC+ didn’t seem to care and didn’t budge, although they might change their thinking now that a new variant of COVID-19 is around to threaten the global economic recovery. Oil prices plummeted on Friday as a result, which I will discuss further below.

In Europe, we are in the midst of a transition of government in Germany, which has grabbed headlines on this side of the pond since Germany is the largest, strongest and arguably most sensible country in the Eurozone. Let’s see how that turns out. If this isn’t enough to keep you busy wondering what might happen next, don’t forget that the debt ceiling is looming in the US, and I have scarcely heard a word about it even though the ceiling will be reached in three weeks or so. This will undoubtedly involve more US-style political theatre, including a smorgasbord of partisan manoeuvring and wrangling in the run-up.

In global equities (as with all markets I am discussing below), the first four days of the week didn’t matter because it was all about Friday. In fact, given the sharp downward move in global equity markets yesterday, about the only good news I can offer is that if you have stayed invested in China through the turmoil there during the last several months, you eked out a small gain this week whilst equity markets were crumbling elsewhere. Here are the rather ugly results for global equity markets for the week.

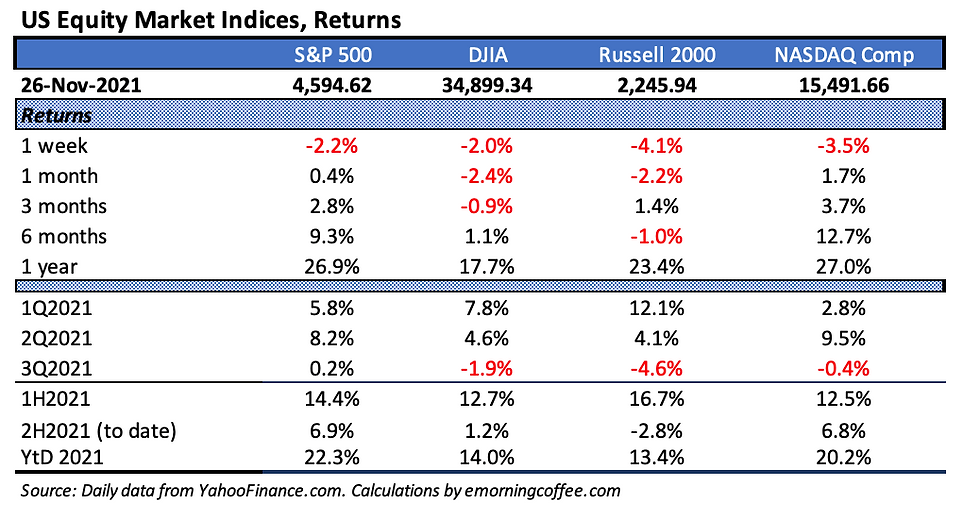

Drilling down into US equities, it is difficult to come up with anything constructive to say because all of the indices were down sharply on the week. The small cap proxy Russell 2000 got hammered the hardest, whilst the cyclical DJIA was the best relative performer. I don’t really think there is much information in comparing the indices this week since all were hit hard as investors raced to the exits. Perhaps most interesting is that the work-from-home, vaccine and consumer non-cyclical companies were loved once again, rallying on Friday, whilst any company involved with travel and entertainment (airlines, cruise ships, travel agencies, rental cars, etc), or involved with energy or financial services, got absolutely destroyed. In a matter of one or two days, investors have turned back the clock, and it suddenly feels as if we are seeing rotation reminiscent of the early weeks of the pandemic. Here’s how the US indices performed last week.

US Treasuries sold off sharply up to Thanksgiving on strong and clearly inflationary US economic date. However, as soon as this narrative was gaining traction (again), the new COVID-19 variant turned sentiment on its head. Inflation changed from being a worry to old news on Friday, as investors raced out of risk assets into the safety of US Treasuries. The yield on the 10-year UST had increased sharply early in the week, reaching a closing yield of 1.67% on Tuesday, only to stabilise and then fall significantly on Friday as investors shifted their asset mixes to risk-off categories. As far as I am concerned, government bonds are not the place to be, and a one-day rally doesn’t change my mind one bit.

Aside from US Treasuries, other safe haven assets had mixed performances this past week, with gold being the outlier. Market fear was not enough to keep gold from declining off its recent highs, as the precious metal was down 3.4% W-o-W. Gold briefly performed like a haven early on Friday as it increased $30/oz early in the session, but by the end of the day – even as risk sentiment stayed firmly in the “fear” area – it gave back all of its gains. In currencies, the Yen was a beneficiary of the sentiment shift to risk-off as investors moved into this safe haven currency (as well as into Swiss Francs).

I discussed oil prices earlier, but as you can see in the table above, the performance was not pretty W-o-W. The price of oil had been under pressure recently anyhow, but then it completely collapsed on Friday as investors quickly concluded that the new COVID variant could dampen global economic growth, and hence, the demand for oil.

Although Bitcoin and its crypto brethren are often mentioned as an inflation hedge and / or as a store of value, neither characterisation has held water the last few weeks. BTC suffered a volatile week, closing on Friday at its low for the week of $53,570, down 7.5% W-o-W and 9.8% off its intraday high reached on Wednesday. November is about to end, and we are about to begin the last month of a fairly amazing year. Keep in mind that YtD we have seen returns (ex-dividends) of 22.3% on the S&P 500, 16.3% on the Euro STOXX 600 and 9.0% on the FTSE 100. To have not had your portfolio skewed towards equities has come at a severe opportunity cost to investors, not only so far in 2021, but also in 2019 and 2020. However, history has shown that over cycles investment returns drift towards their historical averages. The returns (ex-dividends) over 30-years of the S&P 500 and the FTSE 100 have averaged 8.5%/annum and 3.8%/annum, respectively, whilst the Euro STOXX 600 since 2004 (inception) has averaged 3.9%/annum. Looking at these returns over longer periods doesn’t make me feel great about equities in the coming year, even with the Fed and other central banks continuing to prime the pumps. And at the moment – like others – I am having a hard time taking my focus off of the uncertainty associated with the new Omicron variant (and collateral effects), as well as things like the pending debt ceiling discussion and the “persistent vs transient” inflation debate. My advice? Strap in and hold on tightly because the risks remain clearly skewed towards the downside.

___________________

Note 1: For context, the US will release 50 million barrels from its strategic reserves, just over a two day supply for a country that uses 20 million barrels/day. The US strategic reserve is believed to hold around 650 million barrels of oil.

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Comments