Week ended Jan 23, 2026: EM stocks and precious metals lead gains

- tim@emorningcoffee.com

- Jan 24

- 4 min read

In a topsy-turvy (U.S. holiday-shortened) week, stocks and bonds were all over the place last week although most indices and asset prices (aside from gold and EM stocks) ended the week lower. The VIX (measure of volatility / market risk) spiked to above 20 on Tuesday and Wednesday, with all eyes on the WEF in Davos – or should I say, all eyes on the “leader of the free world” President Trump. The volatility in global financial markets was driven by the rift between the Mr Trump involving his relentless pursuit of Greenland, and the pushback coming from Europe. Ultimately, Mr Trump climbed down, with some sort of undisclosed “deal” being reached that seemed to appease the president and European leaders, at least for now. Investors breathed a collective sigh of relief. The subplot in the first half of the week was the dramatic sell-off in Japanese Government Bonds (“JGB”). Perhaps more importantly although overshadowed, S&P 500 corporate earnings continued with few surprises, and economic data was largely in line with expectations.

WEF, Davos

Let’s face it – whereas Davos usually offers interesting economic and geopolitical insights for investors, this year’s Davos was all about the man himself, Donald J Trump. How he loves to be the centre of attention, and it was no more obvious than at this year’s WEF. I thought Mr Trump’s comments at WEF in Davos were more or less as expected, and he discussed a variety of topics aside from just Greenland. As usual, he was very transparent, talking up his administration’s accomplishments often in contrast to what he deems to be the “failures” of the Biden Administration and Democrats more broadly, not to mention most European governments. Also true to form, his various speeches and never-ending barrage of posts on Truth Social were laced with innuendo and more than one outright mistruths. After one year in office, this is simply Mr Trump’s style, like it or not. Fortunately, most investors have figured him out, and seem to know when to dismiss the often-belligerent rhetoric coming from him and his administration. I take some solace in the fact that if push comes to shove, the bond market will keep the president from doing something really stupid. If you want to listen to Mr Trump’s comments at Davos, you can find the speech on YouTube here.

Japan contagion

Just as Mr Trump took the heat out of the “take over Greenland” issue, the Japanese bond market also settled down. The gap higher in long-term yields on JGBs can be traced to two decisions by relatively new Prime Minister Sanae Takaichi early last week – one calling for a snap election (set for February 8th), and the other calling for a two-year sales tax holiday on food. It was the latter, announced by the PM to Parliament on Tuesday, that caused JGB investors to run for cover, with the 40-year Japanese bond soaring above 4% for the first time ever. Investors are rightly concerned about the horrific fiscal situation of Japan, which has the highest debt-to-GDP of any G7 country at 237% (IMF, 2024), compared to 122.3% for the U.S.A. Of course, there are unique features to the JGB market that have created the high debt over several decades, some of which are unique to the country. The collateral damage into foreign bond markets, including the U.S. Treasury market, can be traced to the fact that the JGB market has been the “go to” for carry trades given their historically low interest rates. Although the JGB market settled, the Yen got a boost on Friday from expectations regarding intervention as the currency approached ¥160/$1.00, rallying on Friday to close at ¥155.71/$US1.00.

…..and keep in mind that the U.S. is in a unique position

It’s important to keep in mind that although the Trump 2.0 administration – in line with every administration since Mr Clinton’s second term – has worsened the U.S. fiscal situation by denting the revenue intake through various tax cuts without reigning in spending. Having said that, the U.S. can get by with the equivalent of “fiscal murder” because of the status of the U.S. Dollar as the global reserve currency and the U.S. Treasury bond market as the largest and most liquid government bond market by far in the world. I thought The #Economist summed it up well recently:

“One answer is that for all of America’s fiscal sins, it looks chaste enough compared with the rest of the rich world. Japan is burdened by colossal debts. France is in a slow-burning fiscal crisis. Britain remains stuck in a low-growth, high-tax funk. Uncle Sam may be indebted up to his ears but at least the American economy is still growing and its demography looks less dire than in other rich places. Its sheer scale, and the dollar’s unique position in the global financial system, are additional virtues. Plus hand-wringing over America’s deficits is hardly new and acting on such worries has historically been an easy way to lose money.”

The Economist, “Why America’s bond market just keeps winning”, January 18, 2026

MARKETS LAST WEEK

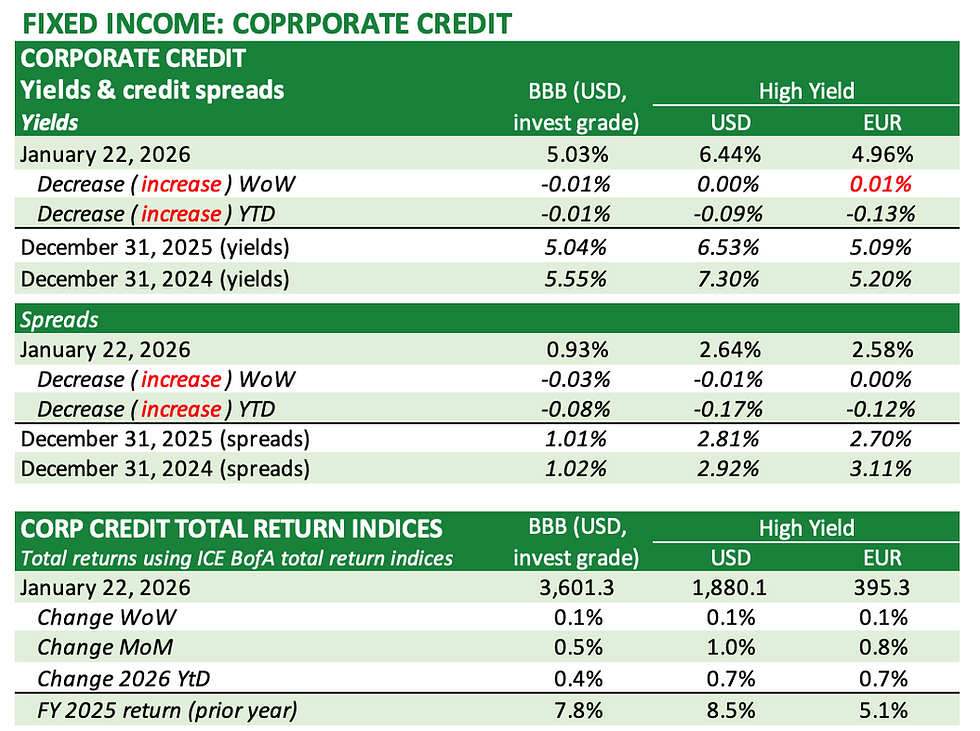

U.S. and European stocks were weaker last week, as Asian equities outperformed. Chinese and emerging markets stocks were the best performers, both gaining on the week. YtD, Asian and emerging market stocks have been the place to be. US Treasuries were volatile, with yields spiking mid-week but then settling and being little changed WoW across the curve. Precious metals continue to be the star performers, with gold closing up 8.4% WoW. The safe haven asset is already up 14.3% YtD, following its 2025 gain of 65.1%. Corporate bond spreads were little changed on the week, both in investment grade and high yield. In currencies, the US Dollar closed sharply lower WoW, and the Yen gained ground, rallying on Friday as expectations regarding intervention developed. Bitcoin was lower last week, closing back below $90,000 but holding on to modest YtD gains. The question that is confounding remains the same: why are risk assets like stocks rallying at the same time as risk-off assets like gold? Something will have to eventually give.

The tables below have been updated for the end of the week

_________________

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Comments