Week ended Dec 15, 2023: Fed serves up a cream puff

- tim@emorningcoffee.com

- Dec 16, 2023

- 7 min read

Updated: Dec 17, 2023

The central bank trifecta did just as had been anticipated last week as far as overnight bank rates, with all three leaving their policy rates on hold. While the Bank of England and ECB continued to dig in their heels as far as their efforts to rein in inflation, the Fed rather unexpectedly threw in the towel on “higher for longer”, signalling a pivot that now appears to be in the cards sooner rather than later. Investors quickly got a sniff of this dovish tilt and bid up risk assets and bonds just after the FOMC decision was announced on Wednesday afternoon. Of course, you can never be quite sure about what the Fed really means until Chairman Powell conducts his post-FOMC press conference, since history has shown that Mr Powell’s words can turn sentiment on a dime. However, this time Mr Powell stuck to the script and risk markets – already running – took off like a rocket.

The combination of a more dovish-than-expected tilt in the FOMC decision and revised economic projections suggesting no recession and three (or perhaps more) reductions in the Federal Funds rate in 2024 – confirmed by Chairman Powell in his press conference – served as a triple-shot of adrenaline that took risk assets and bonds to the moon. A rally in the already frothy US stock market, which began in late October, was extended further and – importantly – has broadened. As an illustration, the small-cap Russell 2000, which was down 5.6% YtD through the end of October, is now up 12.7% YtD. That’s an extraordinary 1.5 month turnaround, illustrating that the US stock rally has broadened significantly.

With the Fed rolling over so quickly and risk markets on fire, it does make me wonder: does the Fed see something that we are not seeing? US CPI data was benign early in the week, in line with expectations, and PPI was slightly better than expected. However, other data released following the FOMC decision seemed to suggest a still-sizzling US economy, one that arguably remains at risk of price pressures. US retail sales were blistering in November, increasing 0.3% MoM rather than decreasing 0.2% as economists had expected. First time jobless claims (released Thursday) were lower than expected for the week ended Dec 8th, signalling a still-solid US jobs market. So with this sort of mixed economic data, one could ask “why didn’t the Fed stick to its guns”? There is little doubt that the so called “last mile” for inflation to get back to 2%/annum will continue to be challenging. Nonetheless, the Fed for one reason or another decided to serve up a cream puff decision that has led to investors thinking “higher for shorter” rather than the former-Fed mantra of “higher-for-longer”.

The euphoria provided by the Fed seeped into other markets, too, even ahead of formal decisions by the Bank of England and European Central Bank the following day. Neither central bank budged as far as policy rates, just as expected, although both had 24 hours to strengthen their resolve against inflation which they did. The Bank of England was clear that “higher for longer” remains on the table because inflation is nowhere near the 2% target. Although CPI is higher than in other G7 countries, it is falling quickly as the UK economy struggles to keep its head above water. In fact, UK GDP in October was more negative than expected, coming in at –0.3% vs expectations of –0.1%. However, Friday’s PMI release was better than expected overall, with manufacturing remaining well below 50 (contraction) but services remaining solidly in expansionary territory. Even so, the combination of high inflation and stagnant growth leaves the BoE with less room to manoeuvre, certainly less than the Fed. Accordingly, expectations are that the BoE will be the last of the trifecta to lower its policy rate, although I have some doubts about this given the speed of disinflation and the severity of a potential economic downturn, mixed data aside.

Similar to its peers, the ECB left its policy rates intact as expected although there was a slight hawkish tilt as far as winding down the PEPP (“Pandemic Emergency Purchase Program”) starting in the second half of 2024. Ms Lagarde also tried to put on her “game face” by pushing back on a pivot in March as investors seem to expect, saying that such easing might not even happen at all in the first half of 2024. Investors more or less brushed this rhetoric aside though, because economic data in the common currency zone is sending a different message, one suggesting much slower economic growth and faster disinflation. Preliminary PMI data for December, released on Thursday, was well into contractionary territory for both services (47) and manufacturing (44.2), and below consensus expectations. It is certainly reasonable to expect the ECB to pivot well before the Fed, although it’s harder to say now with conviction following the Fed’s unexpected dovish tilt the day before the ECB meeting.

Each central bank decision is addressed further below, but first, let’s look at markets this week.

MARKETS LAST WEEK

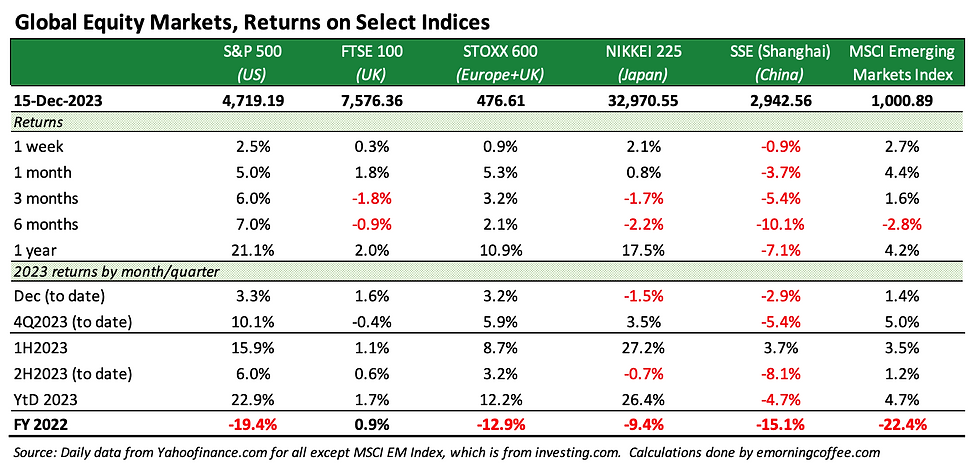

Global equities: Global equities in general continued to register gains led by equity markets in the US, Japan and emerging markets. European bourses were also better this past week, albeit to a lesser extent than in the US. Chinese equities continue to lag and were the only equity market of the ones that EMC tracks that was down last week, which unfortunately has turned into a repetitive pattern. The STOXX 600 reached its highest closing level on Friday since Feb 2, 2022, and the S&P 500 reached its highest closing level on Thursday since Jan 12, 2022.

US equities: US equity indices all performed well this past week, although they all gave back a bit of the week’s gains during the Friday session. The major surprise continues to be the small-cap Russell 2000, which has been on fire as risk assets have been in vogue leading to the rally broadening beyond the NASDAQ and the “Mag 7”.

US Treasuries: The FOMC decision sent bond prices soaring across the board on Wednesday afternoon, with the yield on the more policy-sensitive 2-year note sinking by 27bps intraday as the Fed screamed “pivot”. Given the sharp decline in yields since early November, the total return indices for Treasuries have moved into positive territory, with the 7y-10y index and the 20y index up 3.3% and 3.1%, respectively, YtD.

Corporate credit: “Same old, same old” as far as corporate credit, with yields falling in synch with lower US Treasury yields this week, and credit spreads also grinding tighter across the investment grade–high yield credit spectrum. BBB spreads hit their lowest level this past week since Jan 27, 2022, and high yield spreads hit their lowest level since April 5, 2022.

Other assets: Bringing forward the potential Fed pivot also had sharp effects on currency markets, with the US Dollar weakening against most major currencies. The DX-Y was down 1.4% WoW, bringing the dollar index to a loss YtD. The Yen continued to strengthen against the US Dollar, as the Fed potentially moves to a neutral or dovish stances sooner, and the Bank of Japan continues to send signals that it has no intention of switching away from its ultra-dovish monetary policy, at least not yet. Gold continued to move higher, and oil registered its first weekly gain since the week of Oct 20th, with the influence of OPEC+ waning as the global economy weakens. (If you subscribe to FT, there was a good article this week on OPEC+ and its lower influence on global oil prices. The IEA report for December is here.)

MY TRADES THIS WEEK

My trades this week were to deploy cash from a series of recently-matured UST bills, all of which I rolled into other fixed-income investments in the first part of the week. I bought an ETF containing 25/26 bucket maturity UST notes, as well as two less-than-one-year-to-call BBB corporate bonds. I did keep some cash in less-than-six-month UST bills too. Fortunately I put these trades on Tuesday, before the FOMC decision sent equities higher and yields much lower, which was nothing more than fortunate timing. I stayed relatively short because I will redeploy in equities if here is a pullback in the 1Q24. Towards the close on Wednesday post-FOMC rally, I bought some insurance out to April in the form of SPY puts at 445. It costs a premium but I consider it worth it because my view is that equities have now got ahead of themselves. Recall I wrote a series of covered calls funding puts on AAPL, AMZN, CRWD, LULU and MSFT a couple of weeks ago. All look to have been put on slightly early in retrospect but I am comfortable given the heady levels we’re at now. Let’s see, time will tell. These were flat trades.

RECAP OF CENTRAL BANK POLICY DECISIONS

Before going into details, the graph below from the FT provides a good review of the direction of travel of overnight policy rates in the US, the UK and the Eurozone.

The FOMC / Fed

The FOMC released its policy statement on Wednesday afternoon, which you can find here. In addition, and as is customary at every other FOMC meeting, the Fed revised its Summary of Economic Projections, which include the Fed’s outlook on basic economic metrics as well as the infamous dot plot that provides the expected “direction of travel” of the Federal Funds rate by FOMC Board members.

This chart, along with relatively dovish commentary, spurred risk-on sentiment that pushed stocks higher and yields lower. As the dot plot shows, the Fed is projecting three 25bps reductions in the Fed Funds rate (to 4.50% to 4.75%), at odds with what investors think and what the CME FedWatch Tool is projecting: six 25bps cuts next year, starting in March, with the Fed Funds rate ending the year at 3.75% to 4.00%. Should you wish to watch Mr Powell’s prepared remarks and the press conference following the release of the FOMC statement, you can find the video here (45 mins, Fed website) or read the transcript here.

The Monetary Policy Summary / Bank of England

You can find the Bank of England’s Monetary Policy Statement released on Thursday 14 December here. The BoE left the Bank Rate at 5.25% as expected. It continued to warn of the effects of stubborn inflation, and remained hawkish, especially vis-à-vis the FOMC decision the day before. The next CPI read will be very important.

The Monetary Policy Decision / ECB

The Monetary Policy Decision of the European Central Bank and Ms Lagarde’s press statement can be found together here. As mentioned already, the ECB also kept its overnight bank rates on hold, but they did take a slightly hawkish tilt by announcing its plans to wind down the pandemic-driven PEPP program in the coming years, starting in the 2H2023. Similar to the BoE, Ms Lagarde and the ECB tried to convince market participants that it was not considering a pivot yet, because inflation remains problematic. Keep in mind though that inflation is significantly lower in the Eurozone than in the UK, and also lower than in the US.xxx

THE TABLES

The tables below provide detail across various global and US equity indices, the US Treasury market, corporate bonds and various other asset classes.

Global equities

US equities

US Treasuries

Corporate bonds (credit)

Safe haven and other assets

_________________

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up here. Thanks for your support. ****

Comments