Portfolio update: 2Q2025

- tim@emorningcoffee.com

- Jul 22, 2025

- 9 min read

Performance for the first half of 2025 for most stock and bond indices, as well as many other asset classes, was positive. However, this statement in isolation says little about the enormous volatility that characterised the first half of this year.

The outlook was bleak in early April when I posted the last update of my portfolio (here). Since that time, President Trump has deferred, rolled back and watered down many of the blanket tariffs announced on the infamous “liberation day”. As a result, risk sentiment improved much faster than I would have ever imagined. Much more importantly, the U.S. Treasury bond market settled down after bond vigilantes sent a resounding message to the Trump administration following the initiation of the trade war. Overall, fears of Mr Trump’s poor economic policies were gradually discounted by investors, and now seem to be summarily dismissed in many cases. Even the recent signing into law of the deficit-busting “big beautiful bill” did not seem to rattle investors.

As an investor, I suspected from the time Mr Trump was elected that his belligerent trade rhetoric would eventually rattle markets. However, in line with my style (long term horizon), I chose to largely stay the course, heavily invested in equities throughout the period of turmoil. I did ramp up my market hedges (via SPY puts) in February and March, which proved to be well timed. I even added some risk near the bottom of the market in early April, albeit begrudgingly because of the unpredictability of this administration. This period of turmoil and volatility sent my anxiety to an all-time high, certainly affecting some of my investment decisions and trades. My anxiety was even higher after “liberation day” than before, as I anticipated the sell-off but did not expect such a rapid recovery off the bottom as retail rode to the rescue, buying the dip as has been the case since the pandemic.

Although Mr Trump’s patterns have become fairly predictable by now (i.e. “blah, blah, blah” followed by partial / full capitulation), uncertainty at the end of the first quarter and beginning of the second was at all-time highs. In retrospect, I am probably most grateful that the bond market “bossed” the administration into sorting out their errant policies, leading to positive returns for risk assets in the second quarter that I could not have fathomed in early April. What a ride the second quarter was, hopefully one that will not be repeated anytime soon.

Summary of my portfolio, 1H2025

Regarding my portfolio at the end of June 2025 compared to the end of 2024:

Equities were a slightly lower percentage of my total portfolio at the end of the second quarter than at the end of last year. Fixed income was about the same, and gold, alternatives and cash were higher.

My individual stock portfolio mix changed slightly, with less concentration in the top 10 stocks but similar names. One stock that dropped out of the top 10 was AAPL (now 11th largest holding).

My overall equity portfolio mix by geography changed in the first half of the year due to a combination of slightly more investment dollars allocated to non-U.S. stocks and better performance of European stocks (vis-à-vis US stocks)

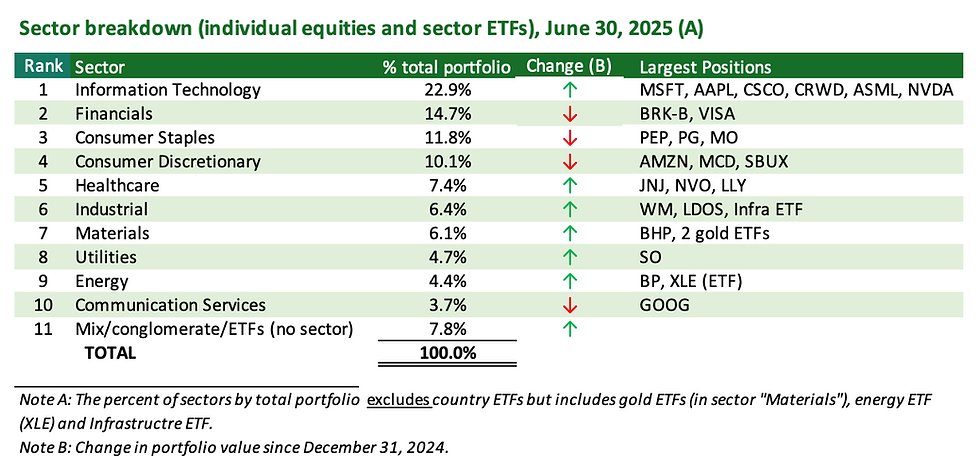

My equity sector mix changed slightly in the first half, with Information Technology and Financials still representing the largest two sectors collectively accounting for over one-third of my portfolio. Notably, the Consumer Discretionary sector decreased and the Healthcare sector increased, both conscience decisions reflecting the economic environment and my views of markets looking ahead.

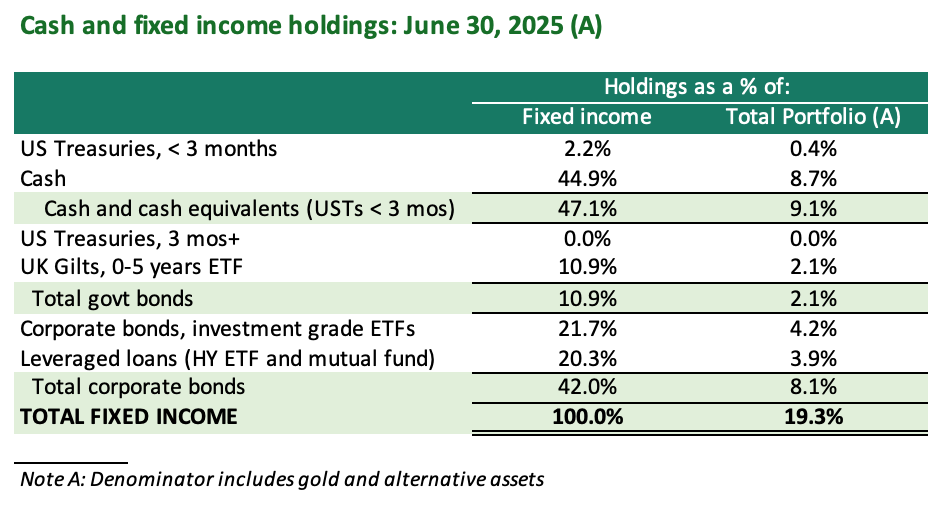

In fixed income (including cash-equivalents), my cash plus less than 3-month US Treasury bill exposure now represent a larger percent of this segment of my portfolio, while corporate bonds represent a smaller percentage (although the exposure to corporates did not change in an absolute sense during the first half of the year).

Ignoring my UK SIPP, my overall return for the 1H2025 was 5.7%. The UK SIPP returned a disappointing 1.4% in £, but a whopping 10.5% in $’s because of the sharp increase in both Sterling and the Euro as the Dollar weakened. In US$’s across all portfolios, my 1H2025 return was 6.4%, compared to the total return on the S&P 500 for the 1H2025 of 6.2% and on the 7yr-10yr UST total return index of 5.4%.

I made reasonable income writing covered calls in the 1H2025, but also got caught out when markets bounced quickly post-“liberation day”, losing a few positions I would have otherwise preferred to keep (especially as the quarter wore on).

Fear of Mr Trump’s policies coaxed me into making more trades than normal for me, although many of the trades were intentional to move to a slightly more conservative portfolio mix reflecting my age and view on valuations especially in U.S. equities.

My uncharacteristic trading volume in 1H2025

In the first half of 2025, I was very active trading, much more so than usual for two reasons:

Volatility was increasing and I was bearish on market direction, a combination of factors than generally results in covered calls working well, and

I felt stocks were richly valued at the beginning and at the end of the first half of 2025, but were cheap around “liberation day”

I traded in and out of 14 different stocks in the first half of the year, making over 60 trades. This is an incredibly out-of-character large number of trades by my standards as I often go long periods with no activity at all. In this instance, the volatility brought on by the Trump Administration first convinced me to lighten risk towards the end of the first quarter, and then to re-add once I felt things were more stable at attractive prices post-“liberation day”. The largest adds in the first half of the year (in order of number of shares, largest to fewest) were NVDA, LLY, CSCO, MO and ASML. I deliberately reduced consumer-facing consumer discretionary names like LULU (complete exit March), SBUX and even AMZN (latter regrettably given recent run). I also reduced my holdings of both AAPL and BRKB, in both instances because I felt the stocks were expensive based on fundamentals. Overall, I was also a net seller of shares in the first half of 2025 in order to generate needed liquidity to support my lifestyle (since I am retired).

Covered calls

I wrote almost 50 covered calls across a variety of positions throughout the first half of the year, up until early May. Most of these options were one to three weeks in duration, so I was willing to capture less “time value” premium to reduce the unknown associated with the future. These positions generated a low five figure income during this period, but I did get caught out on a few positions, one in particular that in retrospect I regret (even though the shares are now stupid expensive) – CRWD. I wrote calls on my CRWD position on several occasions because the significant volatility in the shares made the options very attractive. In fact, options on CRWD accounted for more than 50% of my covered call option income in 1H2025. However, towards the middle of the second quarter, CRWD took off like a rocket and I began to have shares called away from me, leaving me with only a small stub in this cybersecurity company that I had considered core. I will re-enter when and if reality sets in. Other names on which I focused as far as covered calls were shares that I thought were getting expensive, including BRKB, AAPL, V, MSFT and NVDA, not losing any shares in these names that I did not want to reduce.

Macro hedges (SPY puts)

Recall that I have been running macro hedges on my portfolio for six+ quarters, expecting things to worsen. My strategy has been to cover roughly one-third of my equity portfolio with a series of sequential out-of-the-money S&P 500 puts expiring two, three and four months out, which I have been rolling forward each month. In early April as markets collapsed, I held end of May, June and July S&P 500 puts that were suddenly way in the money, providing some offset to the collapse in value of my stock portfolio around “liberation day”. These puts offset some of the stock losses on a mark-to-market basis. I even terminated a couple of the positions at a good profit, but held the remainder because it was unclear where markets would go, and these were in any event hedging (not speculative) positions in place as insurance. I continued to hold the puts throughout the quarter but have stopped rolling them forward, leaving me with much less downside protection than I have run for some time. The last remaining series of S&P 500 puts I own are expiring at the end of July, and these are now out-of-the-money and eroding in value as their expiry nears. I have decided to not continue this strategy unless there is a sudden shift in market sentiment, simply because investors now seem unphased by the combination of heady valuations in U.S. stocks and by Mr Trump’s twist-and-turns, which increasingly amount to nothing. Time will tell if I regret forgoing this insurance.

My portfolio attributes

Asset class mix

The table below shows the breakdown of my portfolio at the end of 2Q2025, and the change (up or down) since the end of 2024.

The equity component of my portfolio decreased from 76.9% at the end of 2024 to 72.4% at the end of the second quarter. I also reduced some positions that I thought were expensive, including BRKB and AAPL. I completely exited LULU just before earnings in March, which proved to be a smart move. My confidence in both SBUX and NOVO also eroded, and I reduced my holdings of both. Gold appreciated throughout the first half of the year, although I did not increase the amount of my holdings. Cash was nearly double the percentage of my portfolio compared to the end of 2024, as I reduced my risk slightly and used the cash to provide lifestyle liquidity.

Top 10 equity holdings

The table below shows my top 10 equity holdings at the end of the first half of 2025. The holdings are ranked by percentage of my total portfolio, including alternative investments. Again, the direction of change is comparing the positions at the end of the most recent quarter (June 30 2025) to the end of 2024. I also included columns on the right side of the table showing the change in the stock price during the first half of 2025, as well as the forward P/E and dividend yield at the end of the quarter.

Of my 30 total equity positions (of which seven are ETFs), 20 had positive returns in 1H2025, and 10 had negative returns. My top performers as far as returns in 1H25 were CRWD, MSFT and NVDA, as well as two country ETFs – Europe and China. My worst performers were BP, BHP, AAPL and NVO.

Breakdown of equities by sector

The table below contains a stratification of my equity portfolio at the end of June by sector, including the 23 individual stocks and four sector-specific ETFs that I own. The geographic ETFs have not been included. The two gold ETFs I own are included in the “Materials” sector, and since gold has powered forward this year, the gains in these two ETFs have more than offset the poor performance of mining / commodities company BHP.

Fixed income holdings (including cash/cash equivalents)

My fixed income holdings including cash at the end of the second quarter are summarised in the table below:

Focusing on the right column (percent of total portfolio), cash increased from 4.9% of my portfolio at the end of December, to 8.7% at the end of June because of sales of stocks during the first half of the year. 8.1% of my portfolio remains in corporate bonds, an area (especially high yield) which has been volatile but has experienced spread recovery not dis-similar to the recovery of global stocks. My high yield exposure continues to be “top-of-the-capital-structure” leveraged loan ETFs, which have continued to offer attractive returns as short-term interest rates have remained static.

Returns

Given my portfolio mix, I am generally pleased with my returns in the first half of 2025. My total portfolio return in USD was 6.4%, of which 1.1% was in current return and 5.3% was in capital appreciation. Major asset categories in which I am invested had returns as depicted in the table to the right, remembering that most of my portfolio is comprised of US /US-listed companies.

As I mentioned already, the weakening of the USD worked in my favour as far as converting foreign currencies back to USD (to calculate my portfolio return in USD). This somewhat understates the continued poor performance of my UK SIPP, which was basically flat in 1H25 because of the poor performance of NVO (down 18.5% in 1H25 and roughly 50% in the last year – so much for playing weight-loss drug companies!), BHP and BP.

What’s ahead

It is almost certain that my trading / portfolio activity will slow in the third quarter as markets acclimate to the Trump Administration and its willingness to test the waters on all sorts of market-influential policies followed often by capitulation. This can effectively be viewed as Trump put, something I detest but have now gotten used to, at least for the time being.

_________________

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Comments