Week ended Feb 9th, 2024: S&P 500 closes above 5,000

- tim@emorningcoffee.com

- Feb 10, 2024

- 5 min read

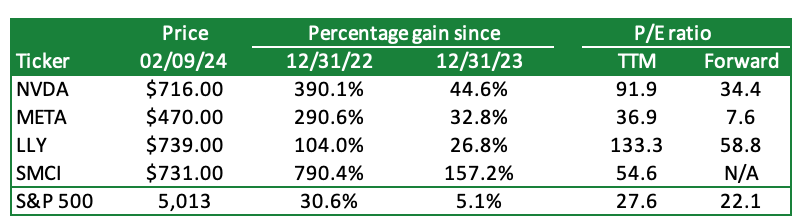

This past week featured another reasonably solid round of earnings from S&P 500 companies, and this continued to provide buoyancy to US equities. The S&P 500 closed Friday for the first time above 5,000, a new record, which says all that needs to be said about sentiment. The funny thing though is that I am getting “meme-like” price vibes from some of the stocks that are driving the gains in the indices, in that they only go up day after day. Is momentum / FOMO starting to lead to separation of some go-go stocks from their underlying fundamental value? Uh….yes! However, it wouldn’t be the first time since the pandemic. Take a look at the table below and see what you think.

This elite group of stocks has had strong gains over the last 13 months, and even stronger gains in first six weeks of 2024. They also have eye-watering valuations. It’s hard to know what to think anymore. Clearly things like AI and weight-loss drugs (like Ozempic and Wegovy) are sending NVDA, SMCI, META and LLY to the moon, but I feel like this is getting out of hand. I am not suggesting these are meme-stocks – far from it! But the price action certainly mimics past meme stock price trajectories. As much as my head tells me to short these over-valued names, doing so now would be like jumping in front of a moving train – your short position would more likely get smashed by upward momentum driven by FOMO than it would to profit from finding enough like-minded fundamental investors to stop this nonsense. If you are invested in one or more of these names, fantastic. If not, it creates a dilemma because FOMO is a strong emotion, and it is difficult to sit and watch rather than participating in what looks to be “easy money”. Given the direction that these stocks are heading, this is unpleasant, but opportunity cost is easier to swallow than real losses.

WHAT HAPPENED LAST WEEK THAT MATTERED

Fed talking heads on the circuit

Various Fed officials were out en masse echoing the outcome of last week’s FOMC meeting and Mr Powell’s post-FOMC commentary, emphasising that monetary policy easing would not likely be on the table until at least May. Investors seem to have come round finally, with the CME FedWatch Tool now suggesting the first rate cut in May (but narrowly) and a total of five 25bps reductions in the Fed Funds rate in 2023, still more aggressive than the Fed’s December dot plot (three 25bps cuts). More importantly, risk markets seem to be over these concerns altogether as stocks continue to edge higher. Bond investors have been less fortunate though with intermediate and long-term UST yields being dragged higher as reasonably solid economic data supports the Fed’s view of “higher for longer.”

US commercial real estate

The concern that garnered plenty of attention in the mainstream financial press last week involved ongoing deterioration in US commercial real estate, and the knock-on effects this might have into lending banks. As we saw 15 years ago during the GFC, issues in a specific asset class like real estate in the US effect domestic lending banks but also splatter foreign banks that are lending to the US commercial real estate sector. The damage that this might inflict is just starting to be realised, and how broad and deep it might become remains to be soon. Although I have done no meaningful research to understand how bad this could become, it must be acknowledged that the global banking sector is much better capitalised than it was going into the GFC. Therefore, my expectation is that there will be a boatload of write-downs, but the only banks that might be troubled are mid-sized and smaller banks that have narrower geographic footprints, similar to what we are seeing now with New York Community Bank (NYCB). The effect on US insurance companies – large investors historically in US commercial real estate – is less clear at this point.

China

Speaking of property, I suspect the only way China will be able to restore confidence in its economy and the country’s financial markets is to swallow a massive restructuring of its property sector. There plenty in common with the Japanese economy in the 1990s, when banks were not cleaned up, stymieing lending and leading to years of deflationary pressures. My bet – or perhaps my hope – is that China does not let this fester so long that it becomes “Japan 1990s v2”. One lost decade in Asia is enough for me!

MARKETS LAST WEEK

I feel like a broken record asking how long the risk-on attitude will continue, and especially, how long certain stocks can continue to gap up 3%-5% day after day. As I wrote last week, February can be a difficult month, but aside from rich valuations, the market doesn’t feel particularly fragile as economic data continues to be largely as anticipated and earnings, albeit mixed in some cases, are generally better than expected. So off we go, until we eventually hit a wall. And believe me – the likelihood is increasing that there will be a wall, one that is out there but we are not seeing at least not yet.

Global equities were generally better this week. China was the best performing market thanks to a series of baby steps by the government to address investor concerns and halt outflows, but this has a ways to run. Only UK equities were negative WoW, which is normal course for this rather mundane market given its composition.

US equities were better off the back of reasonably good earnings and ongoing FOMO, as investors don’t want to miss this run. Bucking its normal trend this year, the small cap Russell 2000 was the best performer, unusual in that yields were increasing all week. The S&P 500 closed above 5,000 for the first time on Friday, with a big driver being the Mag 7 stocks (again). You can access the weekly earnings report for the S&P 500 from LSEG I/B/E/S here.

US Treasuries took it on the chin again this week, with yields increasing across the curve by 12-15bps. The 7-10 year and 20+ year total return UST bond indices are now down 1.7% and 4.95, respectively, YtD. Ouch!

Corporate credit yields increased as UST yields pushed higher, but credit spreads tightened. Like the 2023 recession that never came, the “pending credit crisis” is far from pending, at least based on bets by global credit investors.

·The US Dollar continued to show resiliency, and the Yen is starting to (re)approach ¥150/$1.00, an important resistance point. Oil prices increased sharply, gold prices fell and the price of Bitcoin increased (again).

Financial markets in China are closed all of next week, and following Monday (Feb 19th), US markets will be closed for President’s Day.

MY TRADES THIS WEEK

I did some small trades around two covered call position on AMZN and CRWD that are in the money and expire at the end of next week. I have kept proceeds from maturing UST bills over the last 10 days in cash, not quite willing to go even deeper into US equities in a market that seems to be out of control. Reckon I will just enjoy the ride for now while it lasts.

THE TABLES

The tables below provide detail across various global and US equity indices, the US Treasury market, corporate bonds and various other asset classes.

Global equities

US equities

US Treasuries

Corporate bonds (credit)

Safe haven and other assets

_________________

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Comments