Week ended Dec 12, 2025: FOMC delivers as expected, A.I. bubble concerns resurface

- tim@emorningcoffee.com

- Dec 13, 2025

- 4 min read

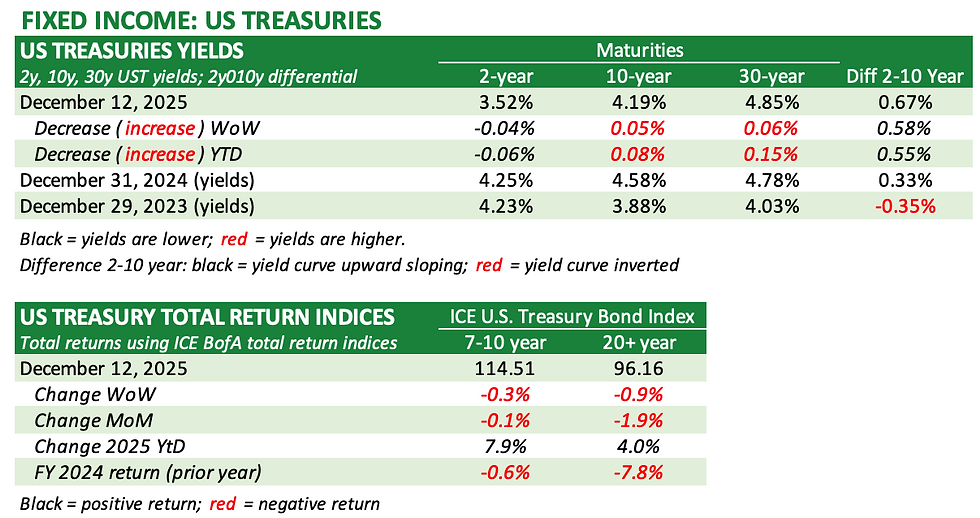

It was looking to be a sideways week for stock investors until Friday, but then A.I. concerns resurfaced causing tech stocks to get hammered as the week drew to a close. To add insult to injury, the bond market shrugged off the FOMC’s much-anticipated mid-week “hawkish rate cut”, with yields moving higher at the intermediate and longer end of the yield curve. Wow – it was all looking so positive last week at this time!

The Fed cuts its policy rate

The decision by the FOMC to lower the Fed Funds rate by 25bps following Wednesday’s FOMC meeting was highly anticipated. Investors were fully onboard with an expected “hawkish cut”, meaning that the FOMC would reduce the Fed Funds rate but signal caution with respect to further reductions in 2026. With the FOMC having limited data because of the government shutdown that ended just four weeks ago, the approach by the Fed’s monetary policy body was not unreasonable. The reality is that there is insufficient data to suggest that inflation is heading firmly in the right direction. Simultaneously, there continue to be mixed signals concerning the labour market, although most economists believe that the jobs market is weakening (or perhaps “normalising”). Investors got their hawkish cut as anticipated, with additional support coming from the revised Summary of Economic Projections. The much-monitored “dot plot” (below) from the summary shows a consensus for only one 25bps reduction in the policy rate in 2026.

Although the FOMC decision was along the lines of what was expected, a marginal pivot towards risk-on occurred anyway, most likely influenced by Chairman Powell’s post-decision commentary and press Q&A. Pundits and investors believed that Mr. Powell (and the Fed decision for that matter) were more deferential to concerns regarding the labour market than inflation, arguably the first time that the dilemma in the Fed’s dual mandate has tilted towards the employment market. Perhaps these comments were subtle and not meant to inspire a tilt towards risk-on, but they certainly seemed to take some of the sting out of this so-called hawkish rate cut and cautionary view towards 2026.

A.I. valuation concerns resurface

So with the Fed serving up exactly what was expected and Mr Powell saying the right things, what could possibly go wrong? It appears that concerns over earnings / outlooks for A.I.-dependent companies Oracle (ORCL) and Broadcom (AVGO) took the wind out of the sails of investors on Friday. It’s hard to say these days what is the tipping point on A.I. valuation concerns, especially since both of these companies reported better-than-expected earnings and fairly robust outlooks. However, the hefty valuations of both stocks (and many other A.I related stocks) leaves nil room for disappointment.

ORCL beat expectations on the bottom line on Wednesday after the close, but fell slightly short of consensus expectations on the top line. Coupled with a massive increase in last quarter’s capex and higher projected capital investment related to A.I. going forward (much to be debt financed), investors stepped back, causing the shares to get hammered.

AVGO clobbered both top- and bottom-line expectations and upped its guidance for the coming quarters, but investors did not like the commentary about higher sales of A.I. chips – which are apparently lower margin than other products – putting pressure on operating margins.

With Oracle down 12.7% and Broadcom down 7.8% on the week, there was simply no place to hide for tech related stocks. The tech-heavy NASDAQ Composite was down 1.7% on Friday alone, wiping out a similar gain for the first four days of the week. Will investors step in as usual and buy the dip early next week? Or is this is another leg down for A.I. narrative stocks? As always, it’s impossible to say.

Markets last week

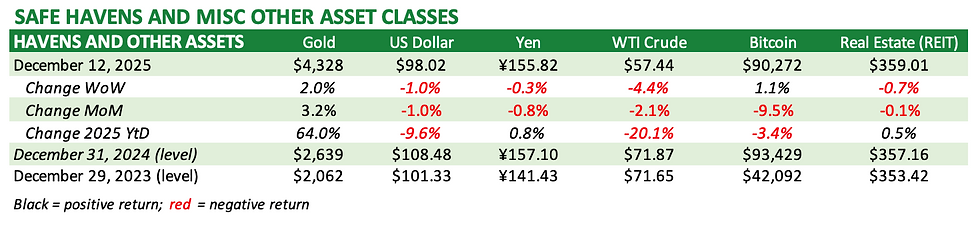

Just when it seemed too good to be true, it suddenly was. To be fair, most global equity markets were a touch weaker on the week, but not significantly. In the U.S., the large-cap DJIA and the small cap Russell 2000 (interest rate sensitive index) both chalked up gains last week, while the tech heavy NASDAQ Composite was sharply lower. Tech shares also dragged the benchmark S&P 500 lower. Fortunately, the sell-off was not broad based as the performance of the various U.S. indices suggest. Moreover, the VIX – a U.S. equity market volatility index – closed below 16 (15.74), suggesting that investor concerns were largely isolated to the tech sector. Even the Mag 7 stocks (aside from meme-like stock TSLA) were battered over A.I. valuation concerns. Rather than move into risk-off U.S. Treasuries, bond investors bailed, too, with ongoing concerns ranging from above-target inflation to on-going threats around the Fed’s independence. Yields pushed higher at the belly and long end of the curve. Safe haven gold seemed to be the major beneficiary of investors’ concerns, with the precious metal up 2% WoW, pushing its YtD gain to a whopping 64%. The greenback has reversed course the last three weeks, and was down another 1% last week as the Fed rate cut was reflected.

Below are updated tables for the week ended December 12, 2025.

_________________

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Comments