Last Week and The Week Ahead (Mar 30 - Apr 3)

- tim@emorningcoffee.com

- Mar 30, 2020

- 6 min read

Updated: Jul 19, 2020

COVID-19, Update: COVID-19 is covered 24/7 by the media, so I really can’t add much other than to provide the weekly update from the World Health Organization (WHO) and track the cases and deaths week to week. The hotspots seem to be Italy, Spain and the U.S., with the U.S. now reporting the largest number of cases.

There is naturally a lot of “fake news” floating around regarding COVID-19, so much so that at times it is hard to distil the truth. However, as many news sources report, the number of cases has clearly been understated in many parts of the world, including in the U.S. and the U.K., because so few people have been tested. I know several people that have or have had symptoms of varying degrees of the coronavirus, and as of now, none have been sick enough to visit a doctor or be hospitalised. I suspect that this is true across the world – many people develop mild symptoms but are not captured in the “confirmed cases” category. This also might mean that the actual mortality rate is overstated. The table from a recent Sky News article – which is worth reading (“Coronavirus: Why Germany has such a low COVID-19 death rate”) – illustrates that mortality rates range from 0.6% in Germany to 10.1% in Italy.

Although it’s had to draw definitive conclusions from such data, a much better indicator might in fact not come from a country, but from the Diamond Princess cruise ship which was kept off the coast of Japan in February whilst people were quarantined. This effectively served as a data lab in a closed setting in which everyone was tested. The mortality rate was 0.91% of all those infected and was substantially higher (7.3%) for those over 70 (7.3%) as expected. (Similarly, the Sky News article shows that mortality in Italy and Spain has been significantly higher for those people over 70.) Determining just how widespread and deadly COVID-19 is will obviously influence policy decisions, specifically decisions on when and where certain segments of a country or its economy might be re-opened as the virus runs its course.

The Equity Markets: It was nice to finally see some green last week in the global equity markets. Investors got some much-needed relief from the relentless selling pressure that had persisted since mid-February. After reaching their lows on Monday, the equity markets in the U.S., the U.K, Europe and Japan rallied – and rallied hard – for three straight days mid-week. The S&P 500 had its best three day run since the 1930s, increasing over 392 points (17.6%) from Monday’s close of 2,237.4 to Thursday’s close of 2,630.07. This was the first time since early February in fact that the S&P 500 index recorded gains on consecutive days. The markets in Europe rebounded off their lows last week. The Japanese equity market was the best performer on the week. In fact, the week was good no matter how you slice it.

I am slightly concerned about Friday because the market was weak from the onset but selling pressure increased as the U.S. market neared its close. The unprecedented amount of fiscal and monetary stimulus unleashed to blunt the economic effect of COVID-19 – especially in the U.S. - clearly cheered investors, but I suspect this “feel good” will wear off quickly. After all, there is still no end in sight of COVID-19, especially in the U.K. and U.S. where – even using the trajectory of China – these countries are a long way from peaking. I have to admit that in spite of last week’s very impressive rally, I remain cautious to bearish in the short term. I hope I am wrong, which is very possible because I was certainly wrong about last week. If you are nervous about the outlook – and I obviously am - this doesn’t necessarily mean you shouldn’t invest. My approach will be to pick the stocks I like and wade back in carefully and in small bite sizes, averaging up or down depending on which way the market goes.

Economic Data: The most amazing figure last week was the jobless claims in the U.S. for the week ended March 21st. An incredible 3.28 million people were laid off in the States as large segments of the U.S. economy shut down. To grasp the magnitude of this, the range for the last 52 weeks had been in the neighbourhood of 200,000 to 225,000 per week. Nonetheless, investors were prepared for a record number of jobless claims so the huge increase was more or less brushed aside. We will get the next read on weekly jobless claims this Thursday morning, and the expectation is that the claims figure will be around 4 million for the week ended March 28th. Other U.S. data coming this week includes automobile sales, some home sales data, and non-farm payrolls and unemployment (expected 3.8%) on Friday. If you want to read more about the extensive fiscal (circa 10% of GDP) and monetary stimulus in the U.S., please refer to my post from last week: “A Choice Between Bad and Worse”.

In the U.K., the policy response to the economic slowdown caused by the COVID-19 pandemic has been well coordinated so far from the Bank of England and the government, similar to in the U.S. After a rate cut and announcement of a £30 bln stimulus package on March 11th, the government followed up last week with an additional package such that direct support now amounts to £57 bln, or circa 2.7% of the U.K.’s GDP (£2.09 trillion last year). In addition, the government is providing up to £330 bln of loan guarantees to businesses during this crisis. Related, the U.K. was downgraded from AA to AA- by Fitch on Friday due to strain on public finances caused by the new stimulus measures (Moody's at Aa2 and S&P at AA).

In the Eurozone, there is less clarity even as consumer confidence hit a five-year low last week, as Europeans become increasingly pessimistic in their outlook. No wonder given the gravity of the COVID-19 situation in Italy and Spain. The economic bloc has relied solely on monetary stimulus from the ECB to date. Unfortunately, there seems to have been no progress so far on the difficult task facing the member states of reaching agreement on a fiscal stimulus plan.

The IMF reported on Monday that it foresees a recession ahead at least as bad as during the Great Recession in 2007-2008. They also reported that 80 countries had already asked for aid, clearly demonstrating the breadth of this crisis.

The Credit Markets: Like the equity markets, the global credit markets also rallied last week reflecting the massive monetary and fiscal stimulus announced by central banks and governments in several major economies. The combination of the Federal Reserve’s announcement that it would be a buyer of investment grade corporate bonds in both the primary and secondary market eased pressure on investment grade spreads, which had been widening quickly. The high yield market also rallied but the case is not as straightforward, aside from its historical correlation with the (suddenly bullish) equity market.

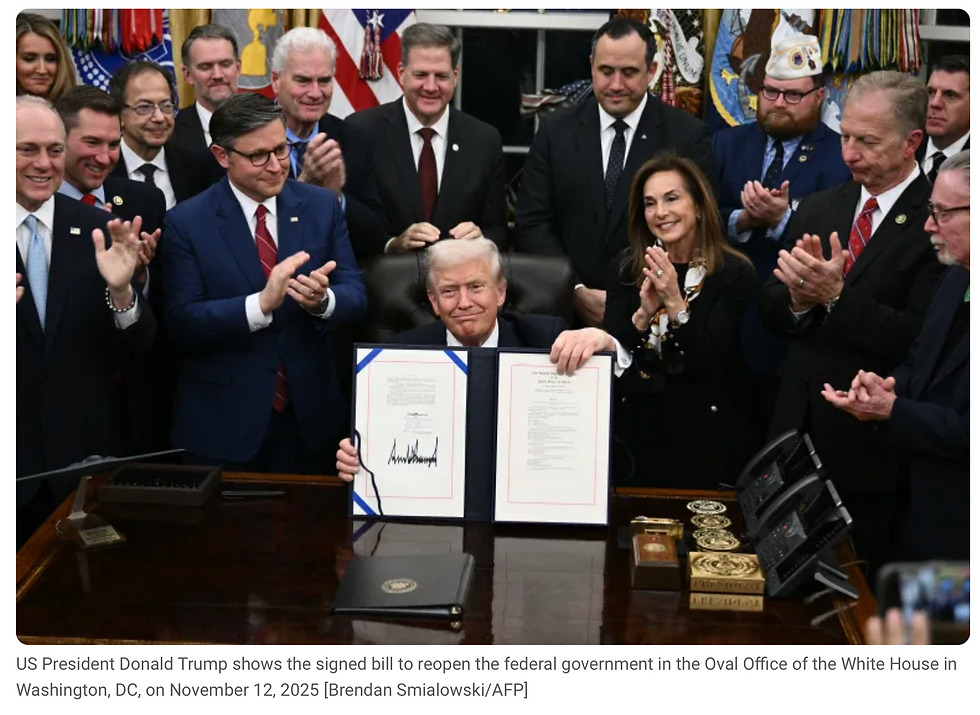

The fiscal stimulus plan passed Friday afternoon by Congress and signed by President Trump does seem to offer relief to small and middle market companies. This includes many high yield issuers in the form of bridge loans / bridge loan guarantees that will buy time for some of the worst-affected companies. Although some pressure might have been released, I remain more bearish on non-investment grade credit (high yield) than on the equity market because defaults will likely increase sharply. The most damage could very well be in the leveraged loan market, and this could have knock-on effects into banks. Most concerning will be troubled sectors like retail, restaurants and travel companies, but as I mentioned last week, the sector that will inevitably prove most troublesome will be oil & gas.

I think with the strong Federal Reserve support for investment grade rated corporate credits, this is probably the place to stay for now because it will provide access to markets for weaker BBB-rated names that were at risk of being shut out of the capital markets. However, this support does not necessarily mean that there will not be downgrades of BBB-rated companies to non-investment grade (like Ford and GM last week), and these downgrades – which often trigger forced liquidations – will continue to put pressure on both investment grade and high yield mutual funds, unit investment trusts and ETFs. Even so, the current yield on the BBB BofA ML index (4.94%) looks very attractive.

Safe Haven Assets: Proving perhaps that it was the scapegoat as global investors adopted a risk-off posture and sought liquidity in US dollars and US Treasuries, gold rallied last week along with the global equity and credit markets. Gold was up nearly 9% on the week, closing Friday at $1,617.30/ounce. This is as odd a correlation as we had the few weeks before, when the price of gold was lacklustre to down even as the global equity markets were tanking. Treasuries also performed well last week, with the 10-year UST closing at its lowest yield of the year (0.72%). Yen was the outlier, weakening (against a weaker US dollar) as risk lessened in the market during the course of the week. The graph below shows the performance of the UST 10 year, gold and yen/dollar since the beginning of the year.

In conclusion, we are in for more uncertainty generally and greater market volatility specifically in the coming weeks, so tread carefully.

**** Follow emorningcoffee.com on Twitter ****

Comments