Results: Week 3 "New Tech / WFH Companies

- tim@emorningcoffee.com

- Feb 19, 2021

- 2 min read

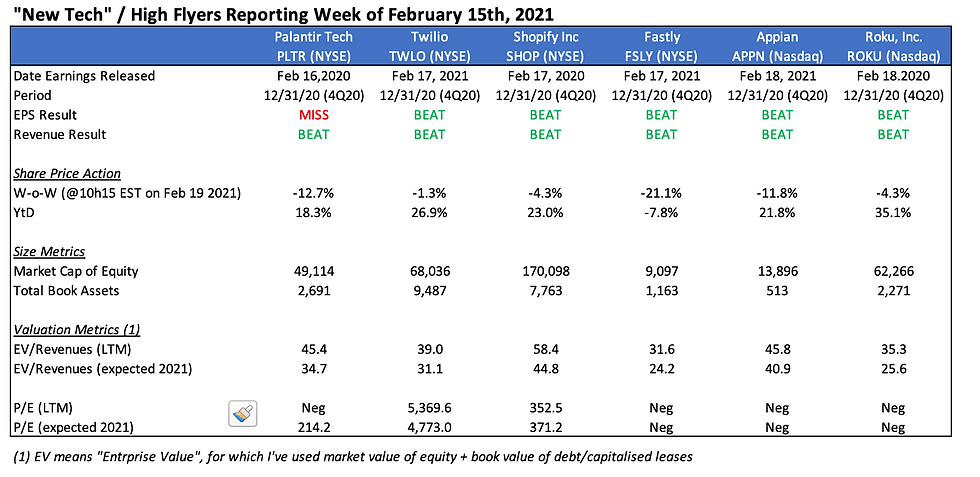

All six “new tech” / high flyers I wrote about earlier this week (Feb 15th) have now released their earnings. The results and some of the company metrics are in the table below.

In a nutshell, every single one of the companies aside from Palantir beat analysts’ earnings and revenues consensus figures. Palantir missed its earnings reporting a loss of $0.08/share against analysts’ consensus of $0.02/share. However, in spite of stronger-than-expected revenues and earnings, the shares of all six companies are down this week as I am writing this. Appian and Palantir are down more than 10%, and Fastly is down more than 20%. I am not surprised to see the best performers be Twilio, Shopify and Roku for reasons I discussed in the earlier article I wrote about these companies (here). These three companies in particular have strong underlying customer trends when you dig deeper into the results, and perhaps not coincidently, all three were both bottom-line profitable in 4Q2020. Each has plenty of liquidity on hand to fund their continued growth. From a relative valuation perspective, TWLO and ROKU look to be the best value plays. As much as I like SHOP, it is still very expensive to me (although I will hold what I have), and in spite of excellent results, the shares wobbled a bit on the outlook (something along the lines of “growth will be strong but it won’t continue at the pace it has”).

As investors, it is perhaps most important that we remember – as impressive as these fast growing and disruptive companies might be – their valuations make them extremely vulnerable to any sort of equity market pullback. Falling share prices do not necessarily reflect weakness in the operations of these companies. Rather, it is more likely to reflect ridiculously high valuations that simply are impossible to support without the ongoing presence of a broad, bullish sentiment and a “perfect” outlook. If you have the patience to wait out a downturn, there are some excellent companies on this list. If not, they might not be for you. In any event, treat them as very volatile stocks, which is easily forgotten in a one-way straight-up market like we have been experiencing.

Next week, we have another group of six exciting companies releasing their earnings: Etsy, TelaDoc, NVIDA, Square, AirBnB and DoorDash. I will write about these high flyers on Monday.

Comments