Week ended Oct 27, 2023: stocks sink

- tim@emorningcoffee.com

- Oct 28, 2023

- 5 min read

TIM’S TAKE

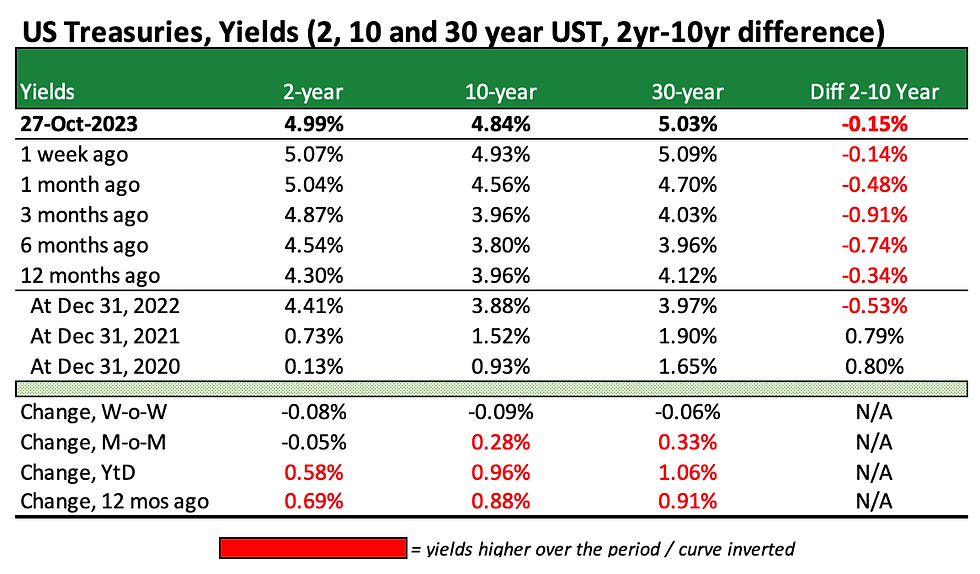

It was a dreadful week if you are long stocks, and it was only slightly better if you are long bonds, thanks at least in part to comments from Bill Gross (ex-PIMCO) and Bill Ackman (Pershing Square) at the beginning of the week. Both “bond gurus” announced that they felt UST yields had peaked. Bonds promptly rallied into these comments, with the yield on the 10y UST – having pierced 5% for the first time in 16 years – falling some 15bps on Monday and remaining range bound below 5% the rest of the week.

Investors were focused on a combination of earnings and economic data, with the former perhaps taking centre stage given how relevant the increase in share prices of the “Mag 7” have been this year. In this respect, all four tech giants – MSFT, GOOG, META and AMZN – delivered the goods as far as beating top and bottom lines, although digging deeper investors seemed focused on i) the growth rate of the cloud business segments of MSFT, GOOG and AMZN, and ii) how the management teams felt about business in the qurters ahead. Cloud isn’t an issue per se for META, although their outlook on the post-earnings management call was the most uncertain of all four. Even with their solid earnings, these four companies could not overcome the severe market downdraft, with MSFT and AMZN ending the week only slightly better, while GOOG and META lost ground. Overall, S&P 500 earnings have not been bad, but there seems to be some reality creeping into markets regarding valuations, perhaps needed and arguably overdue.

As far as economic data, the ECB did nothing, as expected, given that the common currency bloc is stuck between a rock and a hard place as far as poor economic growth and higher-than-desired inflation, although inflation is trending in the right direction. It sounded very much to me like ECB President Christine Lagarde was reading a script drafted by Fed Chairman Jerome Powell. US GDP (real) for the 3Q23 increased 4.9% vis-à-vis 2Q23, and 2.9% compared to the same quarter of the prior year, confirming its expected blistering pace. The week ended with the release of PCE data for September, and investors didn’t react strongly to data that came in more or less as expected. In any event, equities had already been trashed by the time this data was released. I would be remiss not to mention that the House managed to finally choose a new speaker: GOP Rep Mike Johnson from Louisiana. If you want to know more about his (conservative) views, there is a concise article about Rep Johnson on the NBC website here.

As far as my personal portfolio which I updated mid-week (here), I largely stayed on the side lines although I did use the weakness in V (VISA) post-earnings (which were good) to add scraps to a small position I am (re)building. I own three of the four Mag 7 stocks (MSFT, GOOG and AMZN) that reported this week. Although I have owned META on and off since the company went public, I remain concerned about the combination of regulatory and social blowback, recognising that I have missed the mother of all rallies in META this year.

MARKET SUMMARY

US Treasury bonds stabilised this week, no doubt helped by comments at the beginning of the week by Messrs Ackman and Gross that they were unwinding their shorts in USTs and felt yields would head south. Treasuries gapped up in price (yields down), but largely were range-bound the rest of the week, with the 10y UST yield closing at 4.84% (-9bps WoW).

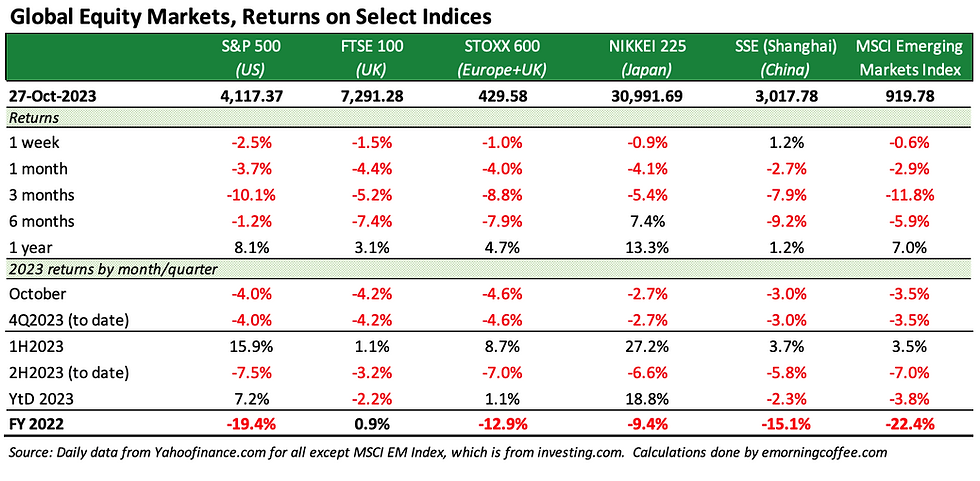

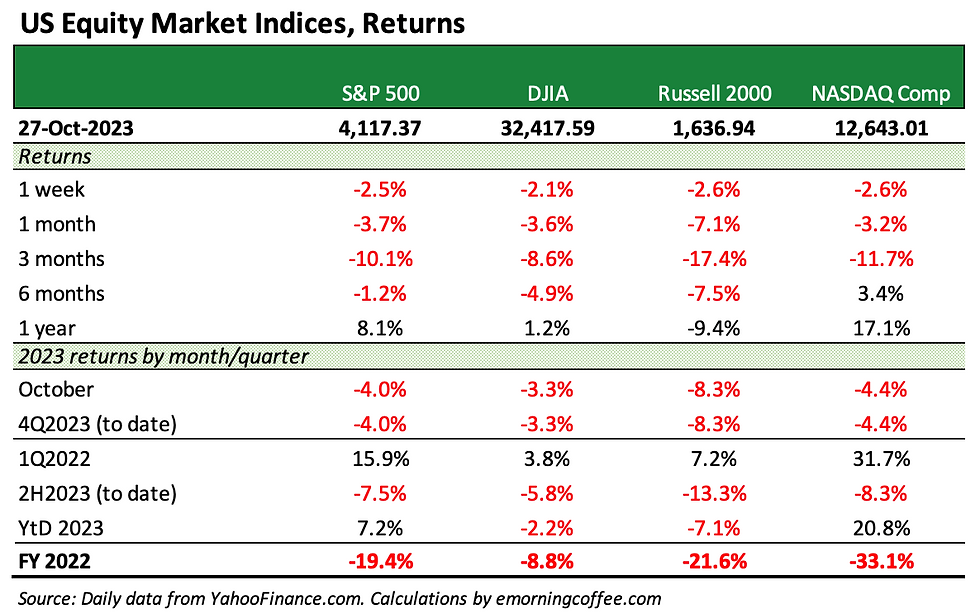

Stocks were generally weaker across the board, aside from Chinese equities. All of the global and US equity indices I track are deep in negative territory for October, adding to losses for the second half of the year. And it all looked so good at the end of the first half of the year ….

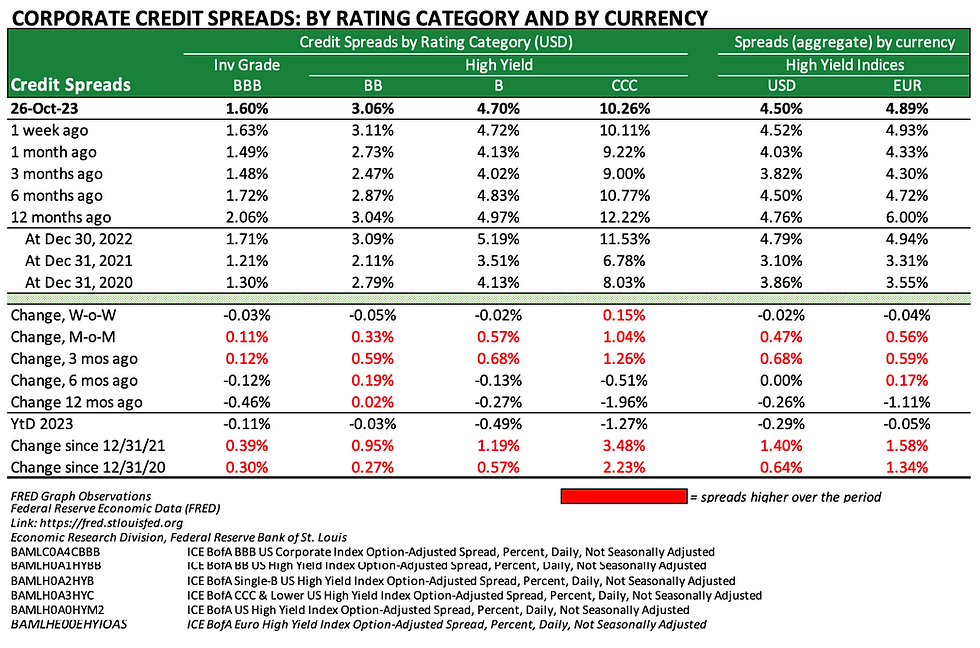

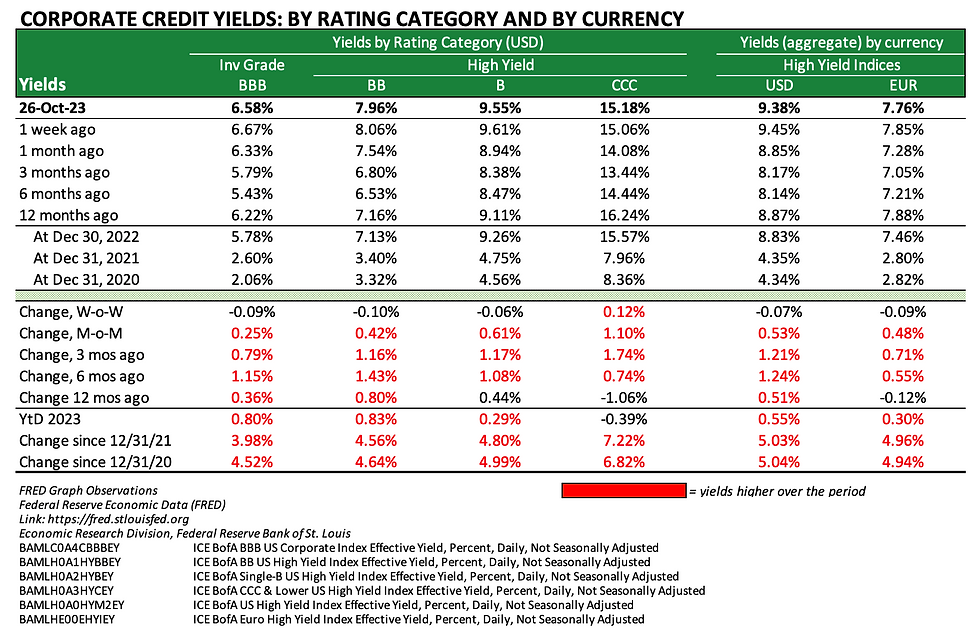

Corporate credit spreads stabilised this week across the investment grade / high yield continuum, no doubt aided by less volatile underlying UST yields helped. Even high yield spreads remained relatively stable as equities were getting hammered, impressive given the correlation between equities and high yield.

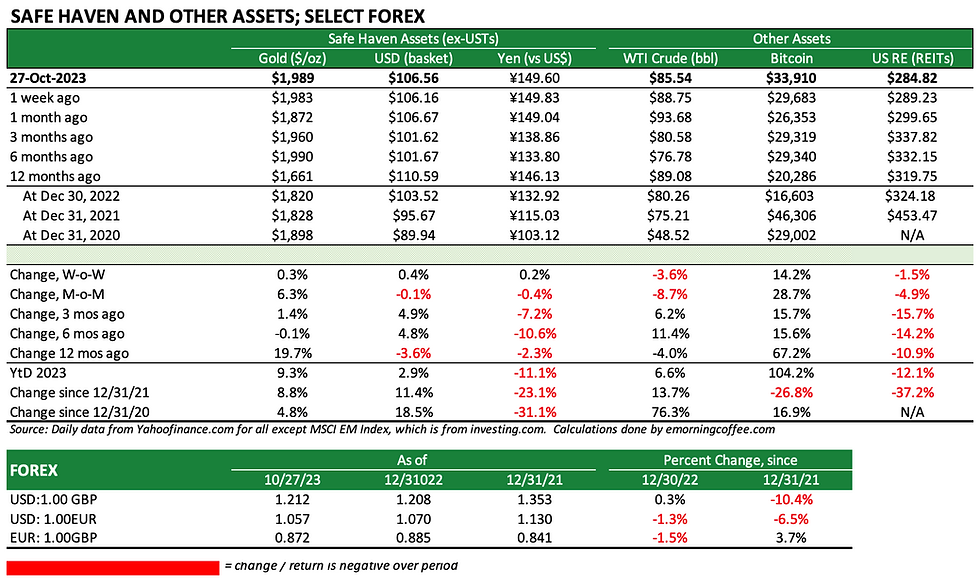

Safe haven gold, the US Dollar and even the Yen were slightly better bid on the week. Each has a different dynamic of course, with perhaps the most interesting being the Yen which is begging for a more hawkish tilt by the Bank of Japan. We get a reminder of this each time the Yen briefly pierces ¥150/$1.00. Bitcoin has been on fire, behaving like a safe haven and rallying – although much more intensively – than gold, which – by the way – is again knocking on the door of $2,000/oz.

Oil prices declined further this week as the Middle East situation did not worsen (more than expected), although we are on the edge of a broader conflict that could quickly change the dynamics of global oil supply. This, along with ongoing concerns on global economic growth, are pulling in opposite directions on oil, and the price direction is difficult to call.

WHAT MATTERS THIS COMING WEEK

Things to watch:

Following the ECB’s rate decision last week (“pause”), the Bank of Japan (Tues), the Fed (Weds) and the Bank of England (Thurs) will make monetary policy decisions this coming week. Neither the Fed nor the Bank of England is expected to change their monetary policy. I would doubt the BoJ would do anything, either, but they must be feeling a lot of pressure on the weakening Yen, and could surpise.

UAW strike in the US remains ongoing, although late in the week Ford and the UAW apparently agreed a new deal for workers. This should open the door to a near-term agreement also with GM and Stellantis.

US government back in business with a new House speaker elected, GOP Rep Mike Johnson (LA). President Biden is aiming to push through a $105 billion support package for Ukraine, Israel, and the US border. The deficit just keeps getting larger and larger. Also, the Nov 17th interim budget deadline is looming, although it sounds like the can will be kicked down the road till after the first of the year.

Uncertainty in the Middle East: direction of and contagion associated with the Israeli-Hamas conflict is ongoing and uncertain, heading in the wrong direction and fear that the war could broaden

Economic data: US employment report for October to be released on Friday. Also from the US, the JOLTS report, ISM manufacturing and ISM services data will all be released. Consumer confidence, retail sales, 3Q23 GDP and CPI is all coming from the Eurozone this coming week. Unemployment and some other data will also be released in Japan.

Earnings wise, another 164 companies release earnings this week. There will be a lot of focus on AAPL(consensus EPS $1.39/sh), which releases its numbers on Nov 2 (Thurs) after the bell. There are plenty of other companies reporting that will be much-watched, including HSBC, McDonald’s Lowes, Caterpillar, Eli Lilly, BP, CVS, Este Lauder, and Shopify, among others. See Refinitiv "This Week in Markets" here for a summary of S&P 500 earnings to date.

Upcoming central bank meetings:

Federal Reserve (FOMC): Oct 31/Nov 1 (expect pause); Dec 12-13

Bank of Japan: Oct 30-31 (same as always although feeling the heat on the Yen) and Dec 18-19

Bank of England: Nov 2 (expect pause) and Dec 14

ECB: Dec 14

THE TABLES

The tables below provide detail across various global and US equity indices, the US Treasury market, corporate bonds and various other asset classes.

Global equities

US equities

US Treasuries

Corporate bonds (credit)

Safe haven and other assets

_________________

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Comments